Simple Tutorials on Trading & Investing

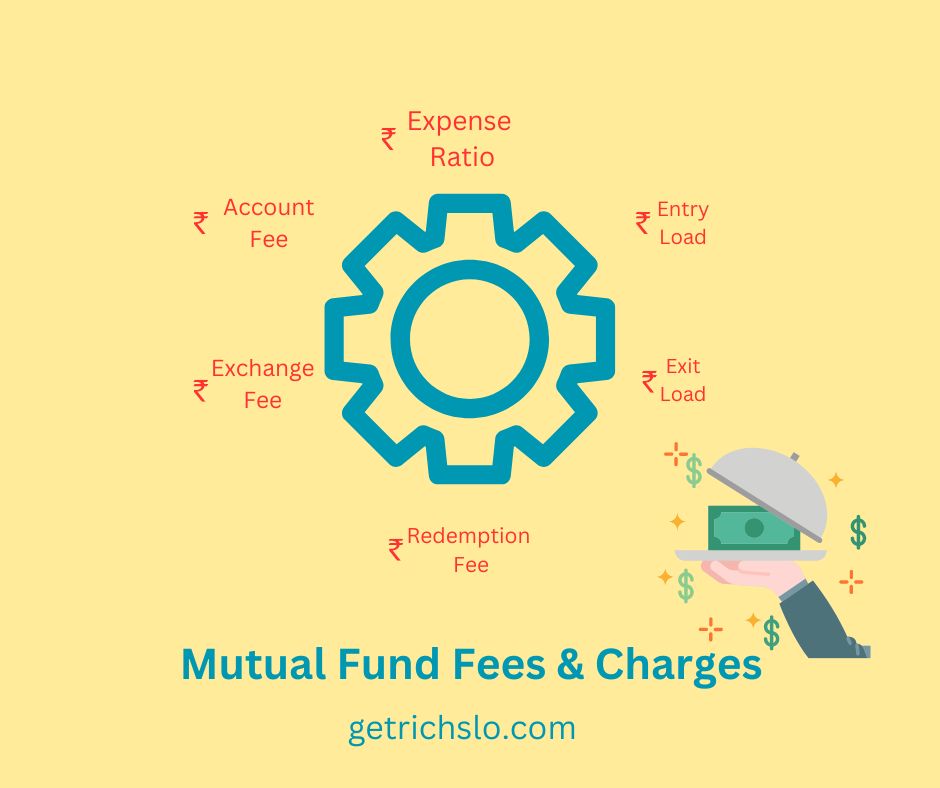

Understanding Mutual Fund Fees and Charges: A Comprehensive Guide for Indian Investors

1. Introduction In India, mutual funds have emerged as one of the most popular investment options for individuals looking to grow their wealth. Mutual funds provide an opportunity to invest in a diversified portfolio of securities managed by professionals, offering the potential for higher returns than traditional savings options. However, investors need to know the fees associated with mutual funds. These fees can significantly impact the returns investors earn over the long term, so understanding them is crucial before making investment decisions.

Read more

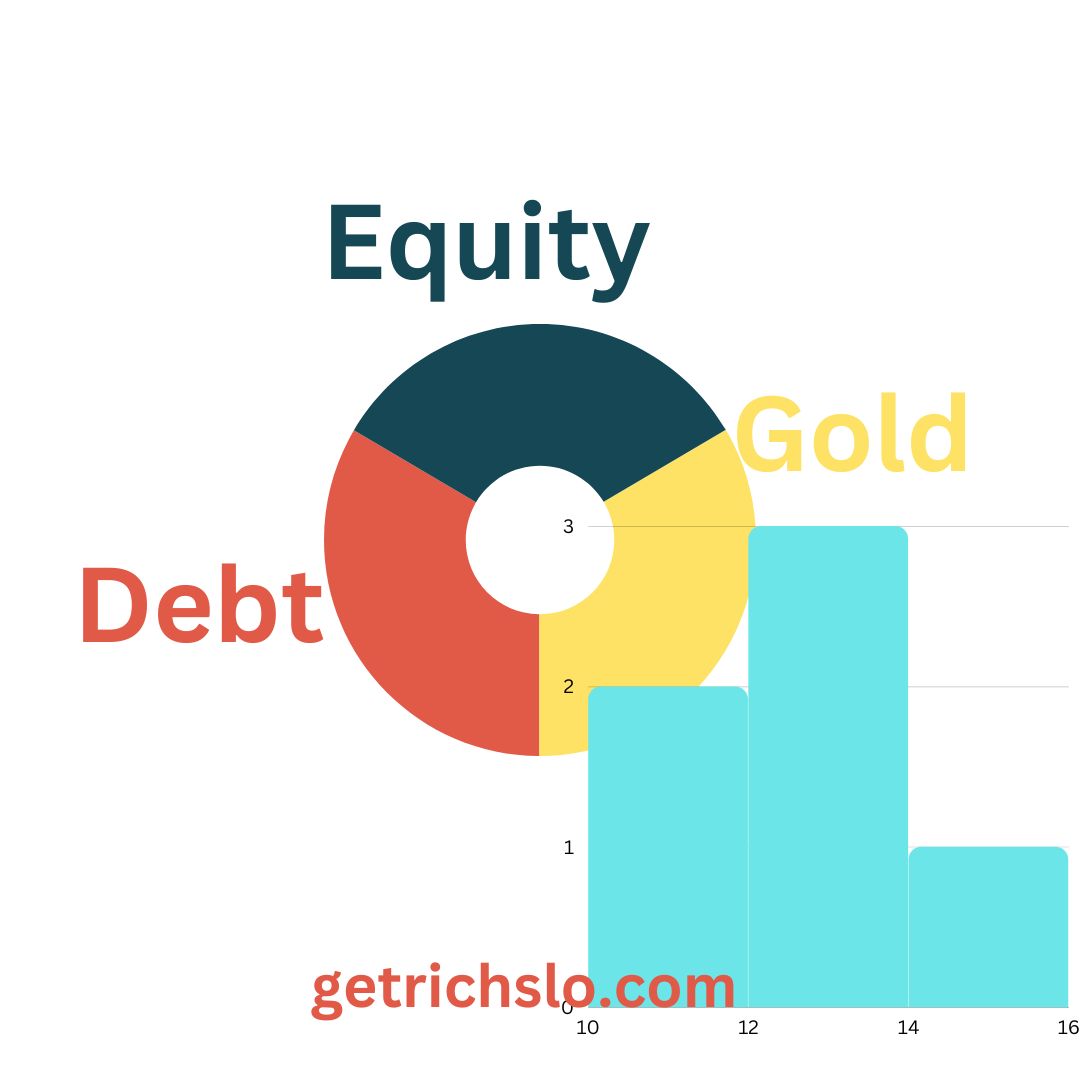

A Beginner's Guide to Asset Allocation and Investment Planning in India

1. Introduction to Asset Allocation Asset allocation is a crucial process in investment management, where an individual divides their investment portfolio among different asset classes, such as equities, debt, and cash. It is the process of deciding how to distribute your investment portfolio across various asset classes to achieve optimal returns for a given level of risk. Asset allocation has become increasingly popular as people seek to diversify their portfolios and minimize risk.

Read more

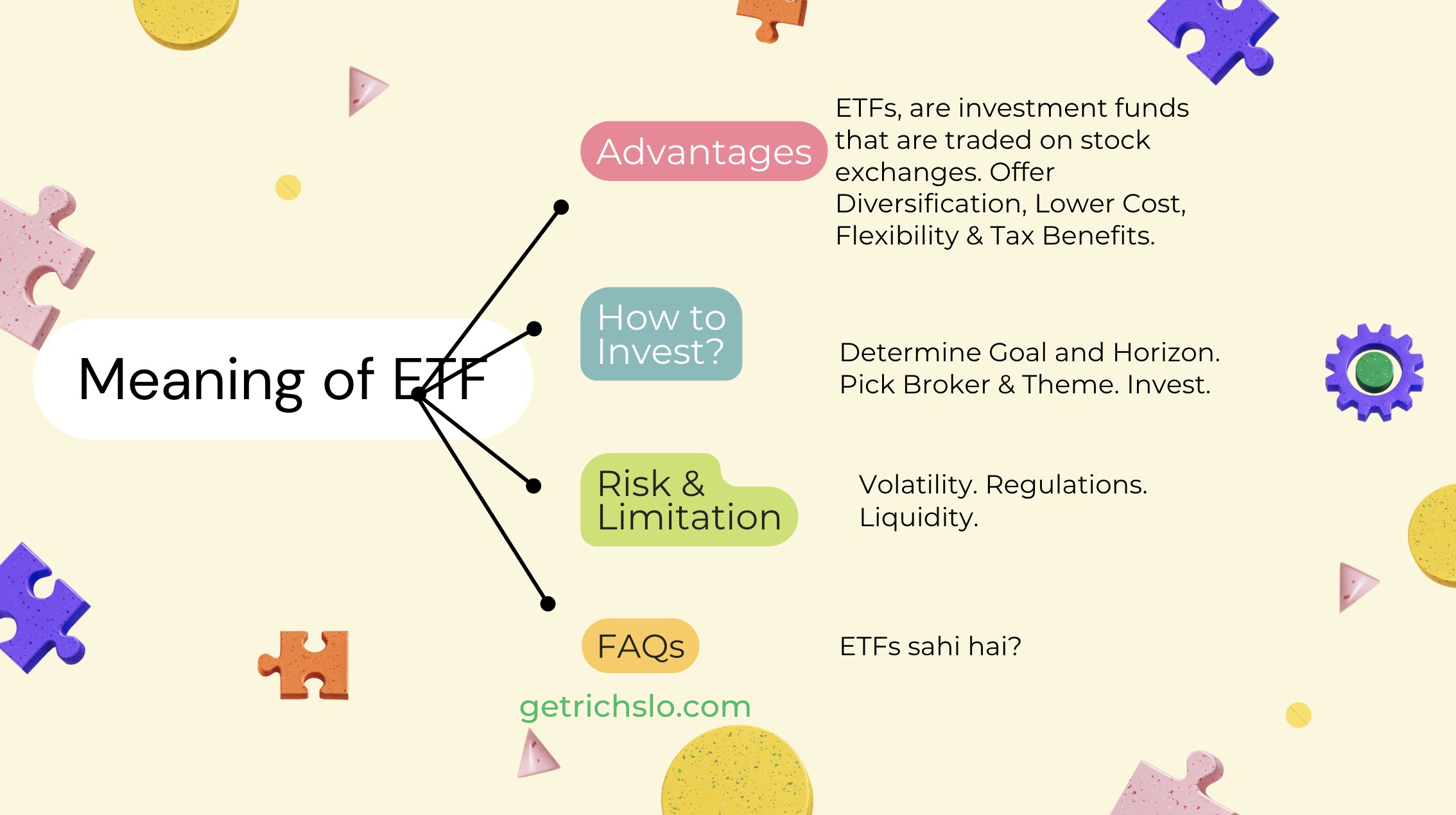

ETF Kya Hai: A Comprehensive Guide to Exchange Traded Funds in India

1. Introduction Exchange Traded Funds, or ETFs, are investment funds traded on stock exchanges, much like individual stocks. They are designed to track the performance of a particular market index, such as the NIFTY 50 or Bank Nifty, or a specific sector, such as technology or healthcare. 2. Understanding ETFs 2.1 Definition and Structure of ETFs ETFs are designed to track the performance of a particular index or sector, such as the NIFTY 50 or the BANK NIFTY.

Read more

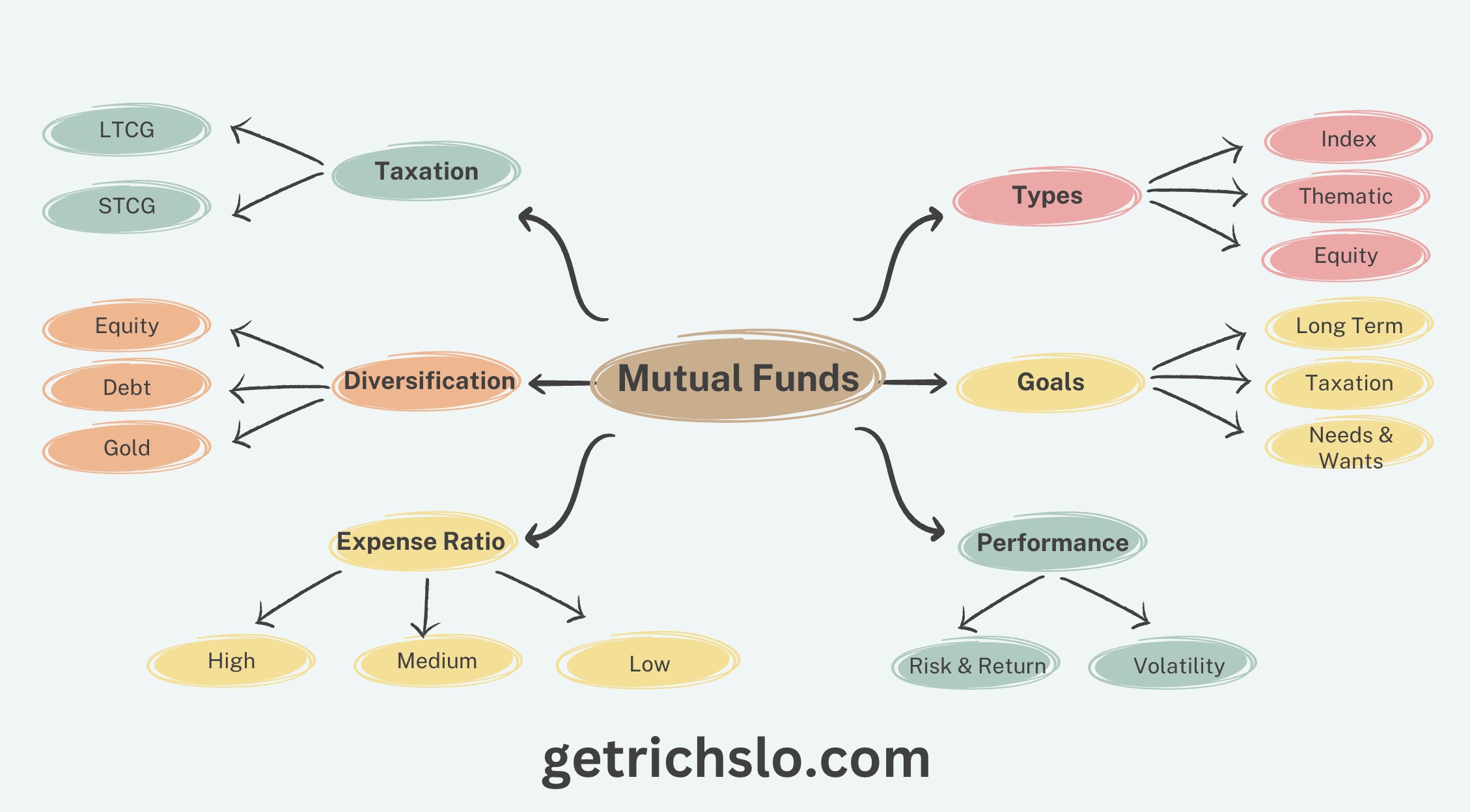

Mutual Funds Kya Hai : A Comprehensive Guide to Investing in Mutual Funds in India

1. Introduction Mutual funds are investment vehicles that pool money from multiple investors and invest the money in a diversified portfolio of stocks, bonds, or other securities. In India, mutual funds are regulated by the Securities and Exchange Board of India (SEBI). Choosing the right mutual fund is crucial for achieving financial goals, as the performance of the fund can have a significant impact on investment returns. In India, mutual funds have become increasingly popular in recent years due to their potential for higher returns and professional money management.

Read more

Mastering Personal Finance: Key Lessons from Popular Books - 1

Introduction Personal finance can be a daunting and overwhelming topic for many, but there are a number of books that provide practical and actionable advice on how to achieve financial success. The Simple Path to Wealth by JL Collins, Your Money or Your Life by Vicki Robin and Joe Dominguez, and I Will Teach You to Be Rich by Ramit Sethi, are all excellent resources for those looking to improve their financial situation.

Read more

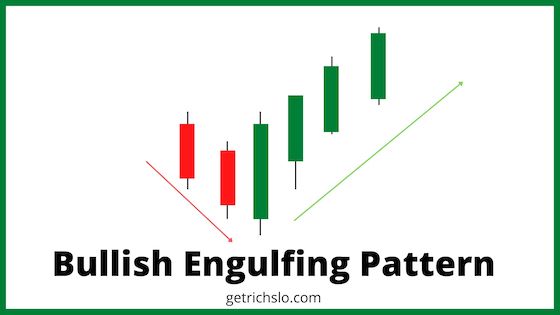

Bullish Engulfing Candlestick Pattern

In this article we will discuss how to trade bullish engulfing patterns. 1. What is a Bullish Engulfing Pattern? A bullish engulfing bar or bullish engulfing candle typically forms after an extended fall in the market. It signlas the point where the bears have started to book profits and bulls have started to show interest. The following pointers will help you to identify a bullish engulfing pattern 1. Previous candle is a red candle.

Read more

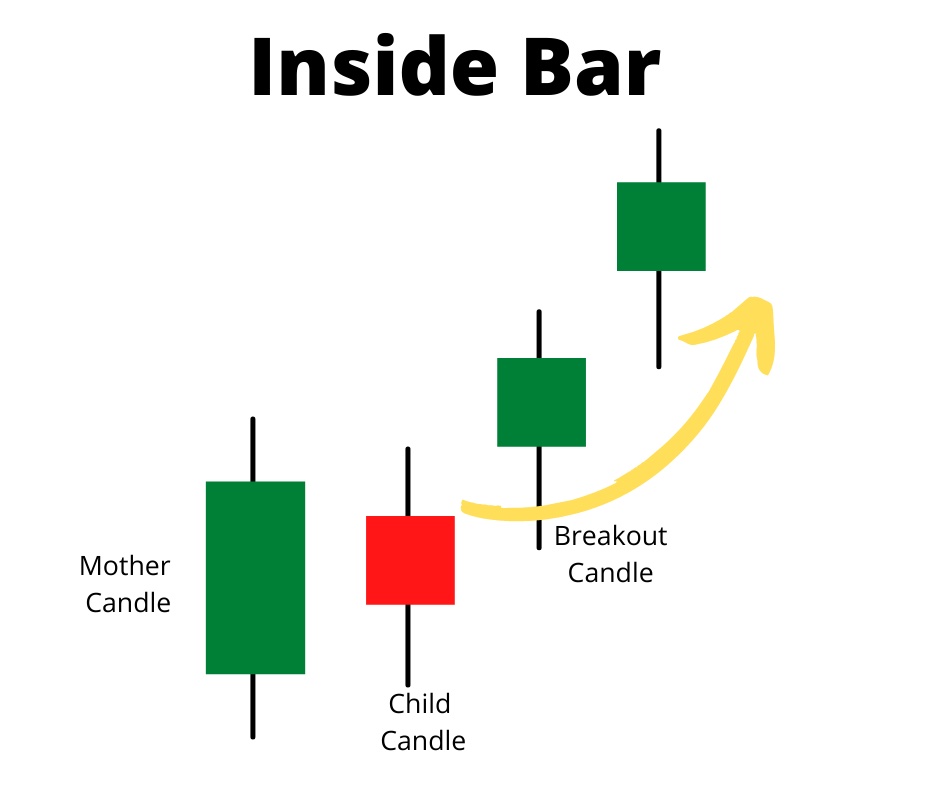

Trading the Inside Bar Candlestick Pattern

The inside bar is a popular breakout system that offers quick results.The pattern formation occurs frequently in the market. The pattern signifies the markets unwillingness to push price higher or lower, and hints to the temporary indecision in the market. Getting a hang of the inside bar strategy can boost a trader’s profit. In this article let us dig deep into the inside bar trading strategy. What does an inside candle mean?

Read more