1. Introduction

Mutual funds have become increasingly popular among retail investors as one of India’s most popular investment options due to their convenience and diversification benefits. However, many investors need to consider the tax implications of their mutual fund investments, which can significantly impact their overall returns. This article aims to provide a technical overview of the tax implications of mutual funds in India, including how to calculate capital gains tax and dividend distribution tax, file taxes on mutual fund investments, and adjust mutual fund investments based on tax implications.

1.1 Brief overview of mutual funds and their popularity among investors

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of assets such as stocks, bonds, and other securities. In India, mutual funds are regulated by the Securities and Exchange Board of India (SEBI), and various types of mutual funds are available, including equity, debt, and hybrid funds.

Mutual funds have become increasingly popular among retail investors in India due to their convenience, diversification benefits, and professional management. According to data from the Association of Mutual Funds in India (AMFI), the mutual fund industry in India has witnessed significant growth in recent years, with assets under management (AUM) reaching INR 38.25 lakh crore (approximately $515 billion) as of February 2022.

1.2 Importance of understanding tax implications while investing in mutual funds

While mutual funds offer many benefits to investors, they are subject to various tax implications that can impact the returns investors earn. Therefore, investors must understand the tax implications of their mutual fund investments, including how to calculate capital gains tax and dividend distribution tax, file taxes on mutual fund investments, and adjust mutual fund investments based on tax implications.

Failing to consider the tax implications of mutual fund investments can result in lower net returns, and in some cases, investors may end up paying more taxes than necessary. Therefore, investors need to have a sound understanding of the tax implications of mutual funds to make informed investment decisions.

2. Types of Mutual Funds and their Tax Implications

Mutual funds come in various types, each with its unique investment objective and asset allocation. Consequently, the tax implications of these different types of mutual funds can vary significantly. Therefore, it is essential to understand the tax implications of each type of mutual fund to make informed investment decisions.

2.1 Tax implications of equity mutual funds

Equity mutual funds invest primarily in stocks and are subject to different tax implications than debt or hybrid mutual funds. In India, equity mutual funds are subject to a long-term capital gains tax of 10% on gains exceeding Rs.1 lakh. For gains less than Rs.1 lakh, there is no tax implication. Equity mutual funds are subject to a flat tax rate of 15% for short-term gains.

2.2 Tax implications of debt mutual funds

Debt mutual funds invest primarily in fixed-income securities such as bonds and are subject to different tax implications than equity or hybrid mutual funds. As per the recent changes in the tax structure for debt funds, specific categories of debt mutual funds will attract short-term capital gains tax if they invest less than 35% of their assets in equities. As mentioned earlier, the amendment to the Finance Bill 2023 has created three categories of mutual funds for taxation. In addition, debt mutual funds are subject to a long-term capital gains tax of 20% with indexation if held for more than three years. For short-term gains, debt mutual funds are subject to a flat tax rate based on the investor’s income tax slab.

2.3 Tax implications of hybrid mutual funds

Hybrid mutual funds invest in a mix of equity and debt securities and are subject to tax implications based on the percentage of assets invested in equities. If a hybrid mutual fund invests more than 65% of its assets in equities, it is considered an equity-oriented scheme. Accordingly, it is subject to the same tax implications as equity mutual funds. If a hybrid mutual fund invests less than 65% but more than 35% of its assets in equities, it is eligible for indexation and is taxed at 20% for long-term gains. For short-term gains, the tax rate is the same as that for debt mutual funds based on the investor’s income tax slab.

Understanding the tax implications of different types of mutual funds is crucial for making informed investment decisions. While the recent changes in tax regulations for debt mutual funds may impact the attractiveness of such funds, investors can still benefit from investing in mutual funds if they consider the tax implications and adjust their investment strategies accordingly.

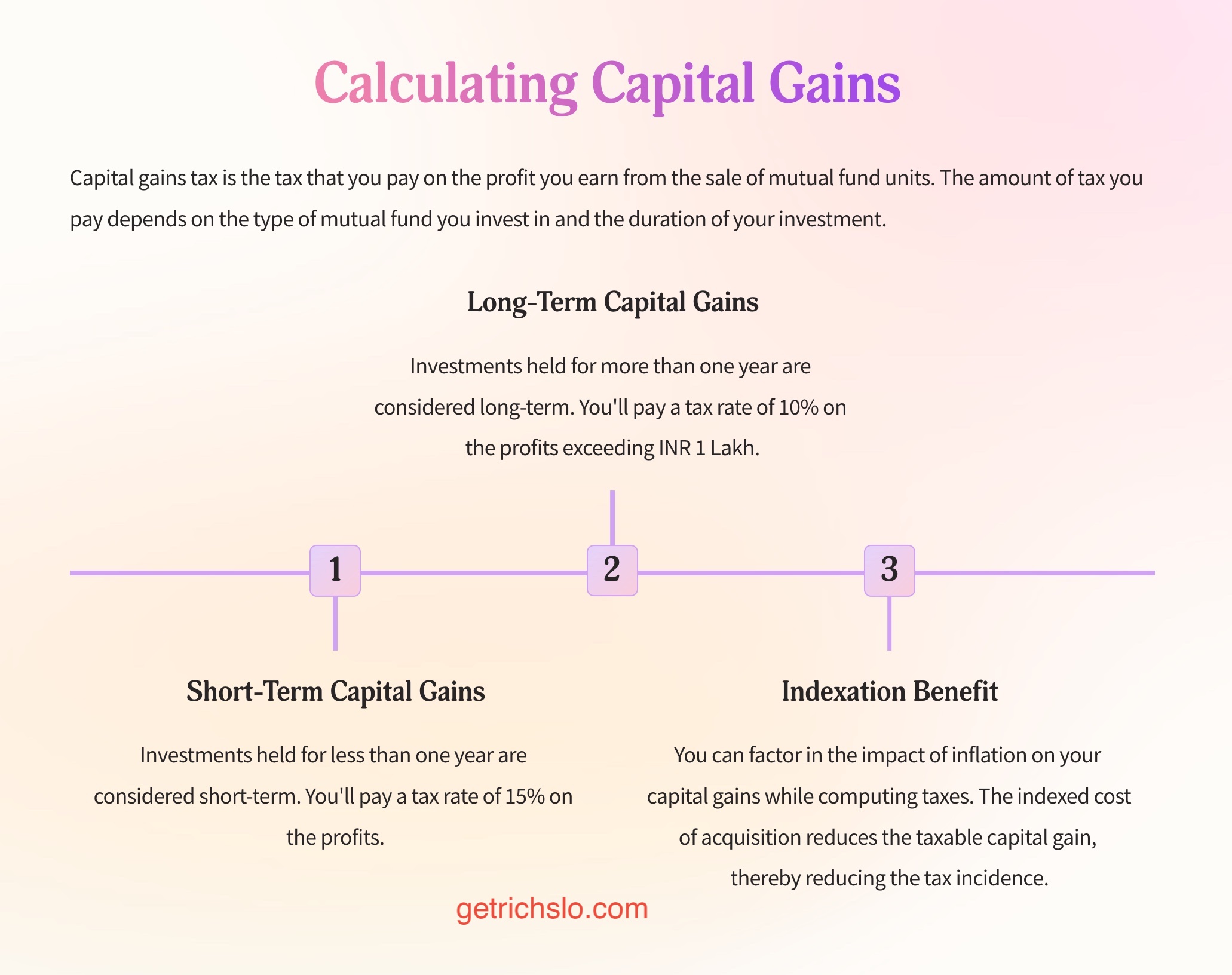

3. Calculating Capital Gains Tax on Mutual Funds Investments

Mutual funds are a popular investment option in India due to their convenience and potential for high returns. However, investing in mutual funds also has tax implications that investors must know. One such tax is the capital gains tax, levied on the profits earned from the sale of mutual fund units. This section will discuss calculating capital gains tax on mutual fund investments.

3.1 Definition of capital gains tax

Capital gains tax is levied on the profit earned from selling an asset such as mutual funds, stocks, or real estate. The tax applies only to the gains made, not the principal amount invested. The capital gains tax is categorized into long-term capital gains tax (LTCG) and short-term capital gains tax (STCG).

3.2 Calculation of capital gains tax on redemption of mutual funds

Calculating capital gains tax on mutual funds depends on the holding period of the investment. If the mutual fund units are sold within one year of purchase, it is considered a short-term investment and attracts STCG tax. On the other hand, if the mutual fund units are sold after one year of purchase, it is considered a long-term investment and attracts LTCG tax.

3.3 Long-term and short-term capital gains tax rates

The tax rates for LTCG and STCG are different. The LTCG tax rate for equity-oriented mutual funds is 10% on gains exceeding Rs. 1 lakh. For debt-oriented mutual funds, the LTCG tax rate is 20% with indexation benefits. On the other hand, the STCG tax rate for equity-oriented mutual funds is 15%, and for debt-oriented mutual funds, it is based on the investor’s income tax slab.

Understanding the capital gains tax calculation on mutual fund investments is essential for investors to make informed investment decisions. By factoring in the tax implications of their investments, investors can maximize their returns and minimize their tax liability.

4. Dividend Distribution Tax on Mutual Fund Investments

Mutual funds are popular investment options. They offer various benefits, such as diversification, professional management, and liquidity. Mutual funds also provide regular income in the form of dividends. However, dividends received from mutual fund investments are subject to dividend distribution tax.

4.1 Definition of Dividend Distribution Tax

The government levies a dividend distribution tax on the dividend distributed by companies and mutual funds. In the case of mutual funds, the tax is deducted before the dividend is paid out to investors. The mutual fund company deducts and pays the DDT to the government.

4.2 Calculation of Dividend Distribution Tax on Mutual Funds

The DDT on mutual fund investments is calculated on the gross dividend amount the mutual fund declares. The tax is deducted at the source, and the investor pays the net amount. The tax rates for DDT on mutual funds vary based on the type of mutual fund and the investor’s tax status.

4.3 Tax Rates for Dividend Distribution Tax

The tax rates for DDT on mutual funds depend on the type of mutual fund and the investor’s tax status. For individuals and Hindu Undivided Families (HUFs), the tax rate for equity mutual funds is 10%, while for debt mutual funds, the tax rate is 25% plus surcharge and cess. For corporates, the tax rate for equity mutual funds is 10%, while for debt mutual funds, the tax rate is 25% plus surcharge and cess. It is important to note that the mutual fund company pays DDT, and investors do not need to pay any additional tax on the dividend received. However, the DDT paid by the mutual fund company reduces the investor’s net returns.

5. Filing Taxes on Mutual Fund Investments

Investing in mutual funds is one of the most popular investment options in India. While it is essential to understand the tax implications of mutual fund investments, it is equally important to file taxes correctly. This section will discuss the steps to file taxes on mutual fund investments and the necessary documents.

5.1 Steps to file taxes on mutual fund investments

The first step to file taxes on mutual fund investments is to calculate your capital gains or dividend distribution tax, as applicable. Once you have calculated the tax liability, you can file your taxes by either using the services of a professional tax consultant or filing your tax returns online.

To file taxes online, you must register on the Income Tax Department’s e-filing website and fill in the required details, including your personal information, income details, and investment details, including mutual fund investments. You can then upload the relevant documents and submit your tax return.

5.2 Required documents for filing taxes

You must have the following documents to file your mutual fund investment taxes.

PAN Card A Permanent Account Number (PAN) card is mandatory to file taxes in India.

Mutual Fund Statement You need to have your mutual fund statement, which reflects your investment details, such as the number of units, purchase price, and sale price.

Capital Gains Statement If you have redeemed your mutual fund units during the financial year, you need to have a capital gains statement, which reflects the gains or losses made on the redemption.

5.3 Deadline for filing taxes on mutual fund investments

The deadline for filing taxes on mutual fund investments is the same as the deadline for filing income tax returns in India, which is usually July 31st for individuals. However, the government may extend the deadline in certain circumstances, such as during the COVID-19 pandemic.

Filing taxes correctly is crucial for mutual fund investments. By following the necessary steps and having the required documents in place, investors can ensure they file their taxes on time and avoid any penalties or legal complications.

6. Tax-Saving Mutual Funds Benefits and Drawbacks

Tax-saving mutual funds are a category of mutual funds that offer tax benefits to investors. They are also known as Equity-Linked Saving Schemes (ELSS), allowing investors to save tax under Section 80C of the Income Tax Act. Investing in tax-saving mutual funds helps reduce tax liability and provides a chance to earn higher returns.

6.1 Benefits of investing in tax-saving mutual funds

One of the primary benefits of investing in tax-saving mutual funds is the tax deduction of up to Rs. 1.5 lakh that can be claimed under Section 80C. This reduces the tax liability for the investor. In addition, tax-saving mutual funds have a lock-in period of three years, which ensures that the investor stays invested for a longer duration and reaps the benefits of long-term investment. Another significant advantage is the potential for higher returns compared to traditional tax-saving options such as Public Provident Fund (PPF) or National Savings Certificate (NSC). ELSS funds invest primarily in equities and equity-related instruments, which have the potential to offer higher returns than debt instruments.

6.2 Drawbacks of investing in tax-saving mutual funds

The primary drawback of investing in tax-saving mutual funds is the lock-in period of three years. Investors can only redeem their units after the completion of the lock-in period. Moreover, in an emergency, the investor can only liquidate their investment after the end of the lock-in period. Another disadvantage is the high-risk profile of ELSS funds compared to other tax-saving instruments such as PPF or NSC. ELSS funds invest primarily in equities and are subject to market risks, which may lead to a decline in the value of the investment.

6.3 Comparison with other tax-saving options

Tax-saving mutual funds are better for investors willing to take market risks and have a long-term investment horizon. On the other hand, PPF or NSC may be better for risk-averse investors who prefer guaranteed returns. In terms of returns, tax-saving mutual funds have the potential to offer higher returns than PPF or NSC over the long term. However, investors should carefully evaluate their investment goals and risk profile before deciding. In addition, it is essential to note that tax-saving mutual funds should not be the sole criteria for investment, and investors should diversify their portfolios across various asset classes.

7. Analyzing the Historical Tax Implications of Different Mutual Fund Categories

Mutual funds are a popular investment option for investors in India due to their convenience and potential for good returns. However, it is essential to understand the tax implications of investing in different mutual fund categories before making an investment decision. This is because mutual fund investments are subject to various taxes, such as capital gains and dividend distribution taxes, which can affect the investor’s overall returns. Therefore, this article will analyze the historical tax implications of different mutual fund categories in India.

7.1 Historical tax implications of equity mutual funds

Equity mutual funds invest in stocks of companies listed on stock exchanges. As per the current tax laws, equity mutual funds held for more than one year are considered long-term capital assets, and gains from the sale of these funds are taxed at 10% if the gains exceed Rs. 1 lakh. However, gains from equity mutual funds held for less than one year are considered short-term capital gains and taxed at a higher rate of 15%.

7.2 Historical tax implications of debt mutual funds

Debt mutual funds invest in fixed-income instruments such as bonds and debentures. The tax implications for debt mutual funds depend on the fund’s holding period. Debt mutual funds held for over three years are considered long-term capital assets and taxed at 20% after indexation. Indexation allows investors to adjust the purchase price of the mutual fund units for inflation, thereby reducing the tax liability. However, gains from debt mutual funds held for less than three years are considered short-term capital gains and taxed at the investor’s income tax slab rate.

7.3 Historical tax implications of hybrid mutual funds

Hybrid mutual funds invest in a mix of equity and debt instruments. The tax implications for hybrid mutual funds are the same as equity and debt mutual funds, depending on the fund’s holding period. Hybrid mutual funds held for more than one year are considered long-term capital assets and taxed at 10% if the gains exceed Rs. 1 lakh, and gains from hybrid mutual funds held for less than one year are considered short-term capital gains and taxed at a higher rate of 15%.

7.4 Analysis of tax implications over different periods

Over the years, the tax laws for mutual funds have undergone several changes. Therefore, analyzing the tax implications of different mutual fund categories over different periods is essential. For example, the long-term capital gains tax on equity mutual funds was introduced in 2018, and the tax rate was increased from 0% to 10%. Similarly, the holding period for debt mutual funds to qualify as long-term capital assets was increased from one year to three years in 2014. Hence, it is crucial to consider the historical tax implications of different mutual fund categories while making an investment decision.

Understanding the historical tax implications of different mutual fund categories is crucial for investors to make informed investment decisions. For example, while equity mutual funds are taxed differently from debt mutual funds, hybrid mutual funds follow the same tax laws as equity and debt mutual funds, depending on their holding period. Moreover, analyzing the tax implications of different mutual fund categories over different periods can provide valuable insights to investors.

8. Adjusting Mutual Fund Investments based on Tax Implications

Mutual funds are a popular investment option for investors in India. However, the tax implications of investing in mutual funds can significantly impact an investor’s returns. Therefore, it is essential to understand the tax implications of mutual fund investments and adjust investment strategies accordingly. In this section, we will discuss the impact of taxes on mutual fund returns and strategies for adjusting mutual fund investments based on tax implications.

8.1 Understanding the impact of taxes on mutual fund returns

Mutual funds are subject to various taxes, including capital gains tax, dividend distribution tax, and securities transaction tax. These taxes are deducted from an investor’s returns and can reduce the overall returns generated by the mutual fund. Therefore, it is crucial to understand the impact of taxes on mutual fund returns.

8.2 Strategies for adjusting mutual fund investments based on tax implications

Investors can adjust their mutual fund investments based on tax implications in various ways. One way is to invest in tax-saving mutual funds that offer tax benefits under Section 80C of the Income Tax Act. Another way is to invest in debt mutual funds that offer indexation benefits, which can reduce the impact of taxes on returns. Additionally, investors can consider investing in direct plans of mutual funds, which have a lower expense ratio than regular plans.

8.3 Impact of switching and redemption on tax liabilities

Investors may also switch or redeem their mutual fund investments based on tax implications. However, switching or redeeming mutual fund units before the stipulated time can attract short-term capital gains tax. Therefore, investors must consider the impact of switching and redemption on tax liabilities before making any changes to their mutual fund investments.

Mutual fund investors in India should consider the tax implications of their investments and adjust their investment strategies accordingly. This can help maximize returns and minimize tax liabilities.

9. Impact of Budget Changes on Mutual Fund Taxation

Mutual fund taxation policies in India are subject to change in every budget presented by the Finance Minister of India. The government’s aim behind changing these policies is to optimize tax revenue and incentivize long-term investments. In this section, we will discuss the impact of budget changes on mutual fund taxation, strategies for adapting to these changes, and an analysis of past budget changes related to mutual fund taxation.

9.1 Analysis of budget changes related to mutual fund taxation in the past

The government has made several changes to mutual fund taxation policies. For example, in the Union Budget 2018, long-term capital gains (LTCG) tax of 10% was introduced on equity mutual fund investments. This significantly impacted equity mutual fund investors who had invested more than a year. However, in the 2020 Union Budget, the government introduced the option of a new tax regime, which allowed taxpayers to opt for a lower tax rate without exemptions and deductions. This led to investors needing clarification about which regime would be more beneficial for them.

9.2 Understanding the impact of budget changes on mutual fund investments

Investors need to stay updated on the changes made in the budget related to mutual fund taxation, as it can impact their returns. For example, if the government increases the tax rate on mutual fund investments, it can reduce the returns for investors. On the other hand, if the government introduces a tax exemption, it can boost investors' returns. Investors should also be aware of the holding period of their investments, as the tax rate on mutual funds is different for short-term and long-term investments.

9.3 Strategies for adapting to budget changes related to mutual fund taxation

One of the strategies for adapting to budget changes related to mutual fund taxation is to stay updated with the latest budget announcements. Investors should also consult a financial advisor to understand the impact of the changes on their investments and how to optimize their tax liability. Investors can also consider investing in tax-saving mutual funds to reduce their tax liability.

Investors should pay close attention to the changes made in the budget related to mutual fund taxation. They should understand the impact of these changes on their investments and adapt their strategies accordingly. In addition, investors can consult a financial advisor to optimize their tax liability and consider investing in tax-saving mutual funds to reduce their tax liability.

10. Minimizing Tax Liability while Investing in Mutual Funds

Thanks to its simplicity and ease of access, investing in mutual funds is a famous investment avenue in India. However, mutual fund investments are not immune to taxation, which could impact the returns on investment. Hence, investors must minimize their tax liabilities while investing in mutual funds.

10.1 Importance of tax planning in mutual fund investing

Tax planning is an essential aspect of investing in mutual funds. It involves identifying the tax implications of different mutual fund investments and devising strategies to minimize tax liabilities while maximizing returns. Tax planning helps investors make informed decisions about their investments and avoid any unpleasant surprises in the future.

10.2 Strategies for minimizing tax liability while investing in mutual funds

Several strategies can help investors minimize their tax liabilities while investing in mutual funds. One such strategy is investing in tax-saving mutual funds, which provide investors with tax benefits under Section 80C of the Income Tax Act. In addition, depending on their tax bracket and investment goals, investors can also consider investing in dividend or growth plans.

Another strategy is holding on to long-term mutual fund investments, as long-term capital gains are taxed at a lower rate than short-term capital gains. Investing in direct plans of mutual funds, which have lower expense ratios than regular plans, is also recommended, thereby reducing the overall tax liability.

10.3 Analysis of tax-saving mutual funds and other tax-efficient investment options

Investors should analyze tax-saving mutual funds and other tax-efficient investment options before investing. They should compare the returns, expenses, and tax implications of different investment options before making an informed decision. Some tax-efficient investment options include Public Provident Fund (PPF), National Pension System (NPS), and Unit-Linked Insurance Plan (ULIP).

Minimizing tax liability while investing in mutual funds is crucial for maximizing returns. Investors should focus on tax planning, adopt tax-efficient investment strategies, and analyze the tax implications of different investment options to achieve their financial goals.

11. Conclusion

Mutual funds are a popular and lucrative investment option for many individuals in India. However, while investors focus on the returns generated by their investments, they often overlook the tax implications associated with mutual fund investments. Therefore, it is crucial to understand the tax implications of different types of mutual funds, budget changes, and strategies for minimizing tax liability while investing in mutual funds.

In this article, we have covered various aspects related to mutual fund taxation in India. We discussed the steps for filing taxes on mutual fund investments, tax-saving mutual funds, historical tax implications of different mutual fund categories, adjusting mutual fund investments based on tax implications, and the impact of budget changes on mutual fund taxation. Additionally, we provided strategies for minimizing tax liability while investing in mutual funds and the importance of tax planning in mutual fund investing.

It is important to consider tax implications while investing in mutual funds to maximize your returns and minimize tax liabilities. As tax laws are constantly evolving, it is recommended to seek professional advice to stay updated with the latest changes and develop a tax-efficient investment plan. Investors can make informed decisions and optimize their investment returns by considering the tax implications while investing in mutual funds.

12. FAQs on Mutual Funds Taxation in India

Investing in mutual funds has tax implications, including capital gains tax on the sale of mutual fund units, dividend distribution tax on the distribution of dividends, and securities transaction tax on the sale of mutual fund units on an exchange.

The units' acquisition cost and sale price need to be known to calculate capital gains tax on mutual fund investments. If the units were held for more than 12 months, they would be considered long-term capital gains; if held for less than 12 months, it would be considered short-term capital gains. The tax rate for long-term capital gains is lower than for short-term ones.

Dividend distribution tax is levied on the distribution of dividends by mutual funds to their unit holders. The mutual fund company deducts this tax before distributing dividends to the unit holders. The tax rate is determined based on the type of mutual fund and the country's tax laws.

To file taxes on mutual fund investments, investors need to obtain the relevant documents, including the statement of account from the mutual fund company, Form 16A for dividend income, and a copy of the consolidated account statement. In addition, investors must declare the gains or losses from mutual fund investments in their tax returns.

Tax-saving mutual funds are mutual funds that offer tax benefits under Section 80C of the Income Tax Act. The investments made in these funds are deductible from the taxable income of the investor up to a maximum limit of INR 1.5 lakhs per year. The benefits of investing in tax-saving mutual funds include tax savings, professional management of funds, and liquidity. However, the drawbacks of investing in these funds include a lock-in period of 3 years and higher expenses.

Capital gains tax is the tax paid on the profit earned from selling mutual fund units. The rate of capital gains tax depends on the duration of holding the units and the type of mutual fund.

Dividend distribution tax is the tax levied on the dividend distributed by mutual funds to its unit holders. The dividend distribution tax rate depends on the type of mutual fund and the nature of the dividend paid.

You can file taxes on mutual fund investments using Form 26AS, which contains details of your investments and their tax implications. You can also use the services of a tax professional or file online using the Income Tax Department website.

Yes, you can save taxes by investing in tax-saving mutual funds, also known as Equity Linked Saving Schemes (ELSS). ELSS offers tax benefits under Section 80C of the Income Tax Act, 1961, with a maximum deduction of Rs. 1.5 lakhs per year.

You can minimize your tax liability while investing in mutual funds by investing in tax-efficient funds, such as index funds or exchange-traded funds (ETFs). You can also hold on to your investments for the long term to take advantage of indexation benefits and lower tax rates on long-term capital gains. Tax planning and seeking professional advice can also help you minimize your tax liability.