1. Introduction

Portfolio rebalancing is an essential process for optimizing mutual fund investments that investors should notice more. It involves periodically reviewing and adjusting the allocation of assets in a portfolio to maintain a consistent level of risk and return. This article will delve into the technical details of portfolio rebalancing, highlighting its importance, benefits, and best practices.

Explanation of Portfolio Rebalancing

Portfolio rebalancing refers to the process of realigning the allocation of assets in a portfolio to bring it back to its original target allocation. This is necessary because market forces constantly push asset allocation away from its target. For example, suppose an investor has a portfolio with a target allocation of 60% stocks and 40% bonds. If the stocks perform well, their value will increase, and the portfolio will become overweight in stocks, say 70%. Rebalancing involves selling some stocks and buying more bonds to return the portfolio to its original allocation.

Importance of Optimizing Mutual Fund Investments through Rebalancing

Portfolio rebalancing is crucial for optimizing mutual fund investments because it helps to control risk, increase returns, and reduce volatility. In addition, it can reduce volatility, which can help investors avoid panic selling during market downturns.

Overview of What the Article Will Cover

This article will cover the technical details of portfolio rebalancing, including how to determine when to rebalance a portfolio, how to rebalance a portfolio effectively, the impact of asset allocation on portfolio rebalancing, common mistakes to avoid when rebalancing a portfolio, how to adjust mutual fund investments based on changing investment goals, top mutual funds for portfolio rebalancing in different asset classes, how to track and monitor a rebalanced mutual fund portfolio effectively, and the role of portfolio rebalancing in retirement planning.

Portfolio rebalancing is a crucial process for optimizing mutual fund investments. Investors should take the time to understand its technical details and implement it as part of their investment strategy. By following the best practices outlined in this article, investors can ensure that their portfolios remain diversified, control risk, increase returns, and reduce volatility.

2. Understanding the Importance of Portfolio Rebalancing

In the world of investments, the term “portfolio rebalancing” refers to periodically reviewing and adjusting the allocation of assets to maintain a consistent level of risk and return. It is an essential tool for investors who want to maintain their desired asset allocation and investment goals. This section will explore the technical details of portfolio rebalancing, its benefits, and its role in achieving investment goals.

Definition of Portfolio Rebalancing

Portfolio rebalancing involves reviewing and adjusting the allocation of assets in a portfolio to bring it back to its original target allocation. This is necessary because market forces constantly push asset allocation away from its target. For instance, if an investor’s portfolio has a target allocation of 60% stocks and 40% bonds, and the stock market performs well, the value of stocks in stocks. Rebalancing involves selling some stocks and buying more bonds to return the portfolio to its original allocation.

Explanation of the Benefits of Rebalancing a Mutual Fund Portfolio

Rebalancing a mutual fund portfolio offers several benefits to investors, including risk control, increased returns, and volatility reduction. By rebalancing, investors can ensure that their portfolios remain diversified, which mitigates risk by spreading it across different asset classes. Additionally, rebalancing allows investors to take advantage of market fluctuations, buying low and selling high, which increases their returns. Finally, rebalancing can reduce volatility, which can help investors avoid panic selling during market downturns.

The Role of Risk Tolerance and Investment Goals in Rebalancing

An investor’s risk tolerance and investment goals determine when to rebalance a mutual fund portfolio. For example, investors with a high-risk tolerance may rebalance their portfolios less frequently than those with lower risk tolerance. Similarly, investors with long-term investment goals may rebalance their portfolios less frequently than those with short-term goals. Therefore, understanding that the rebalancing frequency should align with the investor’s risk tolerance and investment goals to achieve the desired outcome is essential.

Understanding the importance of portfolio rebalancing is essential for investors who want to maintain their desired asset allocation and investment goals. By periodically rebalancing their mutual fund portfolios, investors can control risk, increase returns, and reduce volatility. Additionally, it is essential to consider risk tolerance and investment goals while determining the frequency of portfolio rebalancing to achieve the desired outcomes.

3. How to Determine When to Rebalance a Mutual Fund Portfolio

Mutual fund investments are an excellent way to build wealth and diversify your investment portfolio. However, to get the most out of your mutual fund investments, you must monitor them regularly and rebalance them when necessary. This section will discuss the factors investors should consider when rebalancing their mutual fund portfolio and guidelines for determining when to rebalance.

The Importance of Monitoring Mutual Fund Investments

Regularly monitoring your investments is the first step in determining when to rebalance your mutual fund portfolio. You can use various tools, such as online portfolio trackers, to keep track of your portfolio’s performance. Monitoring your investments lets you identify when your portfolio allocation deviates from your target allocation. This deviation could result from changes in the market or your investment goals.

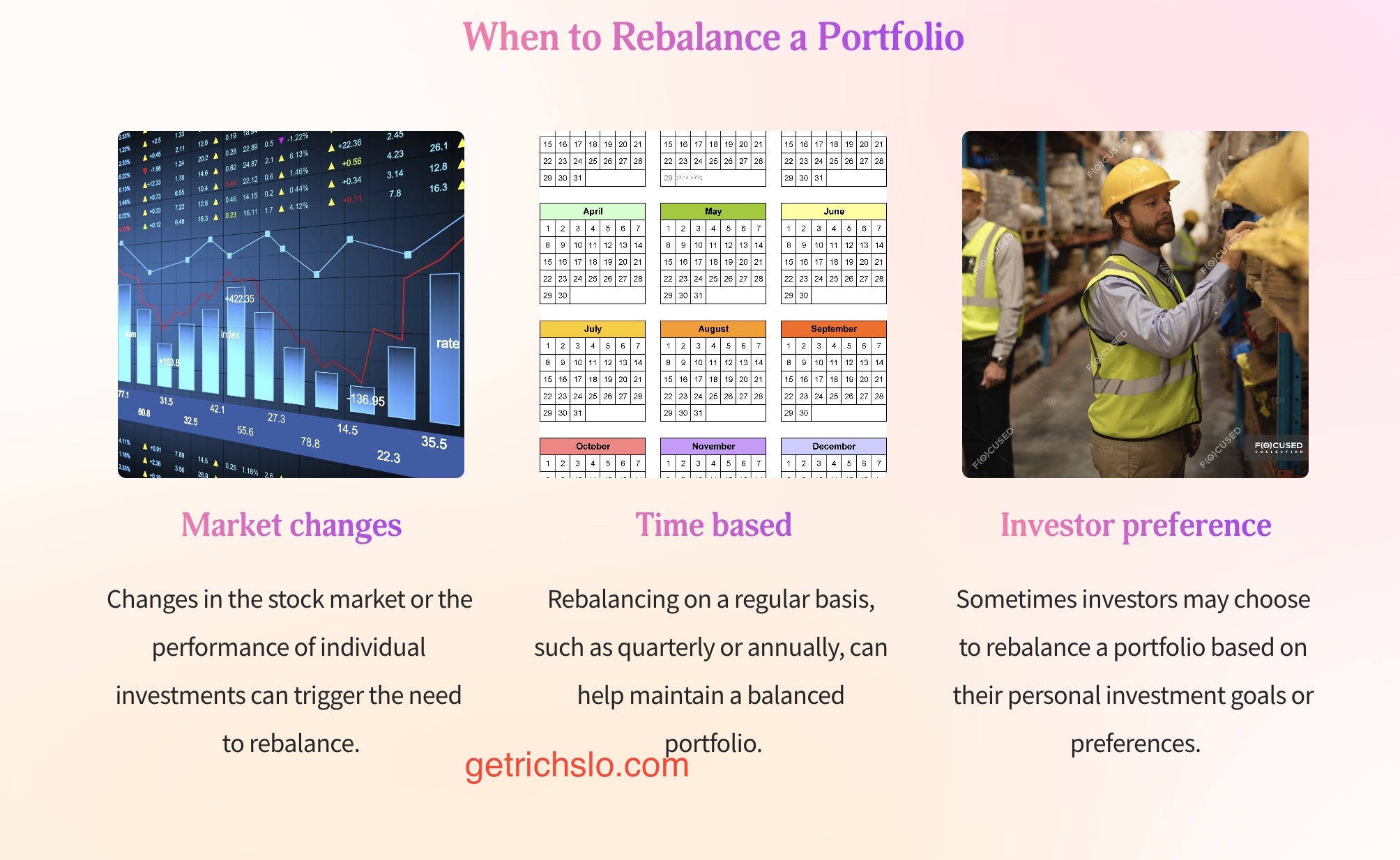

Factors to Consider When Deciding to Rebalance a Portfolio

Several factors should be considered when rebalancing your mutual fund portfolio. The first factor to consider is your investment goals. If your investment goals have changed, you may need to rebalance your portfolio to align with your new objectives. The second factor is your risk tolerance. If you have a low-risk tolerance, you may need to rebalance your portfolio more frequently than someone with a high-risk tolerance. The third factor is the performance of your mutual funds. You may need to rebalance your portfolio if a fund’s performance significantly deviates from your expectations. Finally, changes in the market and economic conditions can also influence whether you need to rebalance your portfolio.

Guidelines for Determining When to Rebalance

There are no hard and fast rules for determining when to rebalance a mutual fund portfolio. However, some guidelines can help investors make informed decisions. One approach is to set a target allocation and rebalance your portfolio when the allocation deviates from the target by a certain percentage, such as 5%. Another approach is to rebalance on a fixed schedule, such as annually or quarterly. Finally, investors may consider rebalancing when their portfolio allocation deviates from their target by a specific dollar amount.

Determining when to rebalance a mutual fund portfolio is critical for achieving your investment goals. Regularly monitoring your portfolio’s performance, considering several factors, and following guidelines for rebalancing can help investors make informed decisions. By following these practices, investors can maintain a well-diversified portfolio that aligns with their investment goals and risk tolerance.

4. How to Rebalance a Mutual Fund Portfolio Effectively

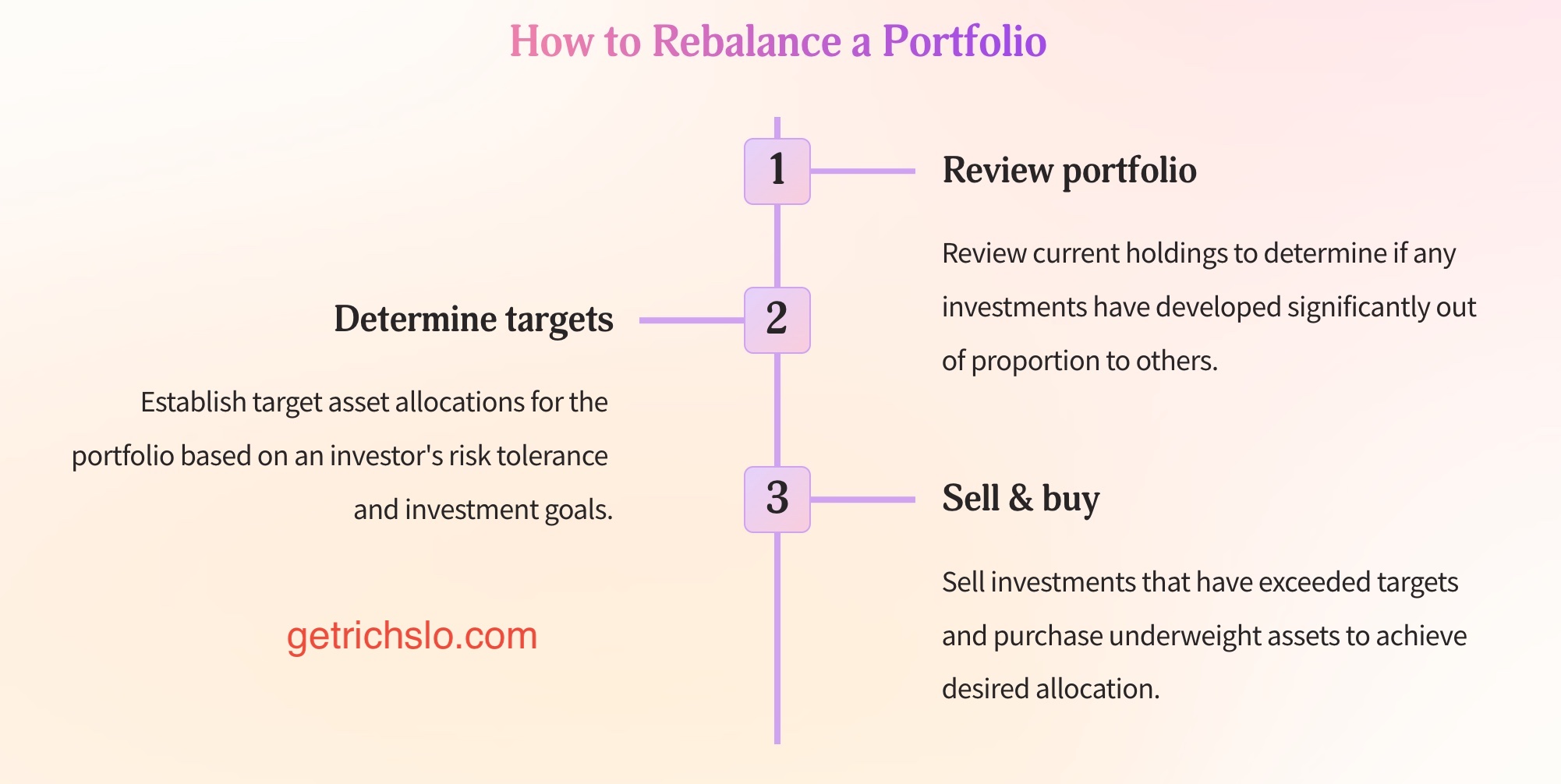

Rebalancing a mutual fund portfolio is an essential process that helps maintain the optimal asset allocation in the portfolio. Portfolio rebalancing involves selling a portion of the over-performing assets and reinvesting the proceeds in underperforming assets. Several methods to rebalance a portfolio include time-based, threshold-based, and hybrid methods. The goal is to ensure the portfolio stays aligned with the investor’s risk tolerance and investment objectives.

Investors must follow some best practices to rebalance a mutual fund portfolio effectively. One of the best practices is to review the portfolio regularly and make necessary changes to maintain the target asset allocation. It is also crucial to avoid frequent changes to the portfolio, as it can increase transaction costs and negatively impact overall returns. Another best practice is to invest in tax-efficient funds and avoid short-term capital gains.

Rebalancing can impact investment returns, depending on the market conditions and the chosen rebalancing method. For instance, if an investor sells a portion of an over-performing asset, they might miss out on some additional gains. Conversely, if an investor sells a portion of an underperforming asset, they might avoid additional losses. Therefore, it is essential to understand that rebalancing does not guarantee better investment returns but can help reduce portfolio risk and volatility.

5. The Impact of Asset Allocation on Portfolio Rebalancing

Asset allocation divides an investment portfolio among asset classes, such as stocks, bonds, and cash equivalents. Asset allocation is a crucial component of portfolio management, as it helps investors manage their risk and achieve their investment goals.

Asset allocation plays a critical role in portfolio rebalancing. Portfolio rebalancing is bringing a portfolio back to its original asset allocation target. By rebalancing a portfolio, investors can maintain their desired level of risk exposure and ensure that their investments align with their investment objectives.

During portfolio rebalancing, investors must adjust their asset allocation to ensure their portfolio reflects their current investment goals and risk tolerance. For example, if an investor’s risk tolerance has decreased, they may need to allocate more of their portfolio to fixed-income securities to reduce their exposure to market volatility.

Investors can use several tools to adjust asset allocation during portfolio rebalancing, including risk tolerance questionnaires and asset allocation calculators. These tools can help investors determine their optimal asset allocation based on their investment objectives and risk tolerance.

It is essential to note that asset allocation is not a one-time event. Instead, it is a continuous process that requires periodic adjustments to reflect changes in market conditions and an investor’s investment goals. By adjusting their asset allocation during portfolio rebalancing, investors can ensure that their portfolio remains aligned with their investment objectives and risk tolerance.

6. Common Mistakes to Avoid When Rebalancing a Mutual Fund Portfolio

Rebalancing a mutual fund portfolio is essential to ensure it is aligned with the investor’s risk tolerance and investment objectives. However, investors must be careful while rebalancing, as mistakes can lead to a suboptimal portfolio or even losses. Some common mistakes investors make when rebalancing a portfolio are chasing returns, overreacting to market movements, neglecting fees, and ignoring asset allocation. These mistakes can cause investors to deviate from their long-term investment plan and potentially miss out on returns.

One tip to avoid these mistakes is to have a disciplined approach to rebalancing. Investors should have a clear plan and stick to it, avoiding impulsive decisions based on market conditions. Another tip is to focus on asset allocation, not individual fund performance. Instead of chasing returns, investors should ensure that their portfolio is diversified and well-balanced across different asset classes. By avoiding these mistakes and following best practices, investors can effectively rebalance their mutual fund portfolio and achieve their investment goals.

7. Analyzing the Historical Performance of Different Asset Classes for Portfolio Rebalancing

Diversification across various asset classes is essential for mitigating risk in an investment portfolio. Asset classes such as stocks, bonds, cash, and real estate perform differently over time due to various economic and market factors. Understanding the historical performance of these asset classes can aid in portfolio rebalancing decisions.

The historical performance analysis involves reviewing the performance of different asset classes over time. For instance, long-term analysis of the S&P 500 Index, a collection of the 500 largest publicly traded U.S. companies, shows that it has provided an average annual return of approximately 10% over the past century. On the other hand, the bond market’s performance has been more stable over time, providing a lower but more consistent return than the stock market. Analyzing the historical performance of different asset classes can provide insight into expected returns, risk levels, and correlations between asset classes.

Diversification involves allocating investments across different asset classes to mitigate risk, as different asset classes perform differently over time. It helps to balance the portfolio and reduce risk. For example, if a portfolio is heavily invested in equities, a market downturn can cause significant losses. However, if the portfolio is diversified with bonds, real estate, and cash, the losses can be mitigated as those asset classes may perform differently in response to economic events.

Diversification across various asset classes can mitigate risk and improve long-term performance.

8. How to Adjust Mutual Fund Investments Based on Changing Investment Goals

When it comes to mutual fund investments, it is crucial to align them with your investment goals. Investment goals can vary based on the individual’s financial position, risk appetite, and future aspirations. Thus, adjusting mutual fund investments to match these goals is essential to ensure you are on track to meet your financial objectives.

Explanation of investment goals

Investment goals can be short-term, medium-term, or long-term, ranging from building an emergency fund, saving for retirement, buying a house, or funding a child’s education. One must set realistic investment goals and align their portfolio with these objectives.

The importance of adjusting investments to match goals

An individual’s investment goals and financial needs may change over time due to changes in personal circumstances, financial obligations, or life goals. Hence, ensuring that the investments are adjusted accordingly to align with these changing goals is critical. Please do so to ensure investment goals and investments are aligned correctly, which may impact the ability to achieve financial objectives.

Guidelines for adjusting mutual fund investments

To adjust mutual fund investments based on changing investment goals, investors should review their portfolio periodically to ensure it aligns with their investment objectives. Rebalancing the portfolio at regular intervals can help align the portfolio with investment goals and ensure that the portfolio continues to meet the investor’s financial objectives.

Investors should also consider risk tolerance while adjusting their portfolios based on investment goals. For instance, an investor with a low-risk tolerance and nearing retirement may want to shift their portfolio to less risky investments. In contrast, a younger investor with a high-risk tolerance may invest in high-risk mutual funds offering higher returns.

Regularly reviewing and adjusting the mutual fund portfolio to match investment goals and risk tolerance is critical to achieving financial success.

9. Top Mutual Funds for Portfolio Rebalancing in Different Asset Classes

Investors always strive to maximize their returns while minimizing their risk. Investing in mutual funds is one of the best ways to achieve that goal. With a diverse range of investment options available in the market, choosing the right mutual fund that fits your portfolio can be a daunting task. However, identifying top-performing mutual funds can help you achieve your investment goals.

This section will highlight top mutual funds for portfolio rebalancing in different asset classes. These mutual funds have proven track records of delivering consistent returns over the years, making them a preferred choice for investors.

Different types of mutual funds are available in the market, such as equity, debt, hybrid, and more. Each mutual fund category has its own set of benefits and risks. Therefore, choosing the right mutual fund that aligns with your investment goals and risk tolerance is essential.

Overview of top mutual funds in different asset classes

Equity mutual funds invest predominantly in stocks, making them high-risk, high-return investment options. Some of the top-performing equity mutual funds in India are

- HDFC Mid-Cap Opportunities Fund

- Axis Bluechip Fund

- Mirae Asset Emerging Bluechip Fund

Debt funds Debt mutual funds invest in fixed-income securities, such as bonds, government securities, and money market instruments. They are relatively low-risk investment options, making them popular among risk-averse investors.

Some of the top-performing debt mutual funds in India are

- HDFC Corporate Bond Fund

- Axis Treasury Advantage Fund

- Franklin India Short-Term Income Plan

Hybrid mutual funds, or balanced funds, invest in equity and debt securities. These mutual funds balance risk and returns, making them suitable for investors with a moderate risk appetite.

Some of India’s top-performing hybrid mutual funds are

- ICICI Prudential Balanced Advantage Fund

- SBI Equity Hybrid Fund

- Canara Robeco Equity Hybrid Fund

Above funds are examples, not recommendations. Consult financial advisor before investing.

Explanation of why these funds are suitable for rebalancing

One of the main reasons these funds are suitable for rebalancing is their ability to generate consistent returns over the years. For instance, HDFC Mid-Cap Opportunities Fund has delivered an annualized return of 22.13% over the last five years, making it a preferred choice for investors looking to invest in mid-cap companies.

Similarly, HDFC Corporate Bond Fund has delivered an annualized return of 9.62% over the last five years, making it a preferred choice for low-risk investment options.

Factors to consider when choosing mutual funds for rebalancing

When choosing mutual funds for portfolio rebalancing, there are several factors that you need to consider, such as expense ratio, fund manager’s experience, historical performance, investment objective, risk tolerance, and more. Considering these factors, you can make an informed investment decision aligning with your investment goals and risk appetite.

Choosing the right mutual fund for portfolio rebalancing is essential to achieve your investment goals. By selecting the top-performing mutual funds in different asset classes, you can create a diversified portfolio that maximizes returns while minimizing risks. However, it is essential to consider several factors before making an investment decision to ensure that you make an informed decision.

10. How to Track and Monitor a Rebalanced Mutual Fund Portfolio Effectively

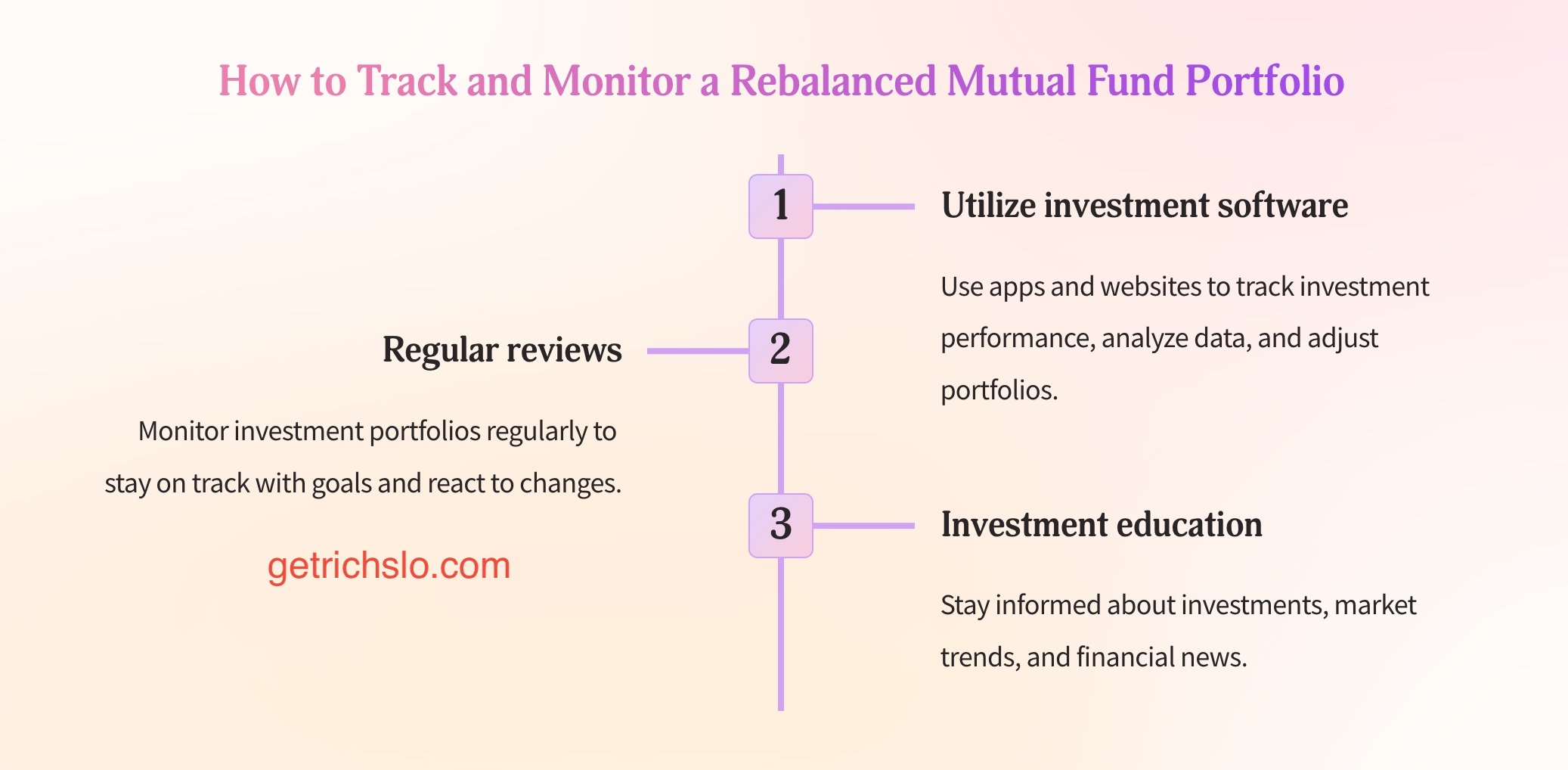

As an investor, it is essential to regularly track and monitor your portfolio’s performance, even more so after rebalancing it. This ensures your portfolio stays aligned with your investment goals and risk tolerance. This section will discuss the importance of monitoring a rebalanced portfolio and the techniques to do so effectively.

The importance of monitoring a rebalanced portfolio cannot be overstated. Regular monitoring can help you detect deviations from your desired asset allocation, enabling you to take corrective action promptly. For instance, if the equity allocation in your portfolio has increased beyond the desired level due to market movements, you can sell some of the equity holdings and reallocate the proceeds to fixed-income investments to restore the desired asset allocation.

There are several tools and techniques that you can use to track and monitor your portfolio. For example, most mutual fund companies provide online portals that allow you to monitor your investments' performance and track the changes in asset allocation over time. You can also use third-party financial planning software or Excel spreadsheets to track your portfolio’s performance and asset allocation. Ensuring that your tools and techniques provide accurate and up-to-date information on your portfolio’s performance is essential.

Adjusting a rebalanced portfolio is critical in ensuring your investments align with your investment goals and risk tolerance. You may need to adjust due to changes in your investment goals, risk tolerance, or market conditions. For instance, if your investment goals change, you may need to reallocate your investments to reflect the new goals. Similarly, if the equity markets experience a downturn, you may need to rebalance your portfolio to restore the desired asset allocation. Therefore, reviewing your portfolio periodically and making necessary adjustments to keep it aligned with your investment objectives is essential.

11. The Role of Portfolio Rebalancing in Retirement Planning

Retirement planning is essential to personal finance management, and portfolio rebalancing is crucial in ensuring your retirement savings stay on track. As you move closer to retirement, ensuring that your investments are appropriately allocated to meet your financial goals becomes increasingly essential. Portfolio rebalancing is the process of adjusting the allocation of assets in your portfolio to match your investment objectives and risk tolerance.

Importance of portfolio rebalancing in retirement planning

One of the critical benefits of portfolio rebalancing in retirement planning is that it helps to minimize risk. As you get closer to retirement, you should shift your investments towards less volatile assets to protect your savings from market fluctuations. Rebalancing your portfolio allows you to adjust your asset allocation to reflect your changing investment goals and reduce the risk of significant losses that could derail your retirement plans.

Guidelines for rebalancing in retirement

To rebalance your portfolio effectively, it is essential to establish a clear set of guidelines that consider your financial goals, risk tolerance, and investment horizon. For example, one common approach to rebalancing in retirement is gradually shifting your investments from equities to fixed-income securities over time. This can reduce portfolio volatility and ensure a more predictable income stream during retirement.

Monitoring your portfolio regularly and adjusting as needed is also essential. As your financial situation changes, your investment goals may evolve, and you may need to adjust your asset allocation accordingly. For example, suppose you experience a significant life event such as a divorce, childbirth, or a spouse’s death. In that case, you may need to revise your investment plan to reflect your changing circumstances.

Overall, portfolio rebalancing is a critical component of retirement planning and can help to ensure that your savings are appropriately allocated to meet your financial goals. By establishing clear guidelines and monitoring your portfolio regularly, you can take control of your investments and build a secure financial future for yourself and your loved ones.

12. Conclusion

Portfolio rebalancing is a crucial aspect of mutual fund investments that allow investors to maintain their desired asset allocation and minimize risk. In this article, we have covered various topics related to portfolio rebalancing, including common mistakes to avoid, historical performance analysis of different asset classes, adjusting investments based on changing investment goals, top mutual funds for portfolio rebalancing, tracking and monitoring a rebalanced portfolio, and the role of portfolio rebalancing in retirement planning.

Understanding the significance of rebalancing and how it can help achieve long-term investment goals is essential. The key takeaways from this article are to create an investment plan that aligns with your goals, regularly review and rebalance your portfolio to maintain the desired asset allocation and monitor your investments' performance.

We encourage investors to take action and optimize their mutual fund investments through rebalancing. By implementing the guidelines in this article, investors can make informed decisions and create a well-diversified portfolio tailored to their investment objectives.

13. FAQs

Portfolio rebalancing is adjusting your investment portfolio to bring it back in line with your desired asset allocation. This is important for mutual fund investments because it ensures that your portfolio is diversified and aligned with your investment goals while minimizing risk.

The frequency of portfolio rebalancing depends on your investment strategy and goals. Generally, experts recommend rebalancing your mutual fund portfolio once a year or whenever your asset allocation deviates significantly from your desired targets.

The best practices for portfolio rebalancing when investing in mutual funds include setting clear investment goals, establishing a well-diversified portfolio, monitoring your portfolio regularly, and rebalancing strategically based on your targets and risk tolerance.

Common mistakes to avoid when rebalancing a mutual fund portfolio include overreacting to short-term market fluctuations, failing to consider tax implications, ignoring transaction fees and expenses, and neglecting to rebalance your portfolio.

Asset allocation is crucial in portfolio rebalancing for mutual fund investments because it determines your overall mix. A well-designed asset allocation strategy can help you achieve your investment goals while minimizing risk, and rebalancing ensures that your portfolio stays aligned with your targets.

Portfolio rebalancing can help you achieve your investment goals faster by keeping your portfolio aligned with your targets and minimizing the impact of market fluctuations. In addition, by rebalancing strategically and regularly, you can maintain a well-diversified portfolio that is optimized for your investment goals and risk tolerance.

The decision to use a professional financial advisor for portfolio rebalancing depends on your level of expertise, investment goals, and preferences. While some investors prefer to manage their portfolios themselves, others prefer to work with a financial advisor who can provide expert guidance and portfolio management services. Ultimately, the best approach is the one that aligns with your goals and risk tolerance.