1. Introduction

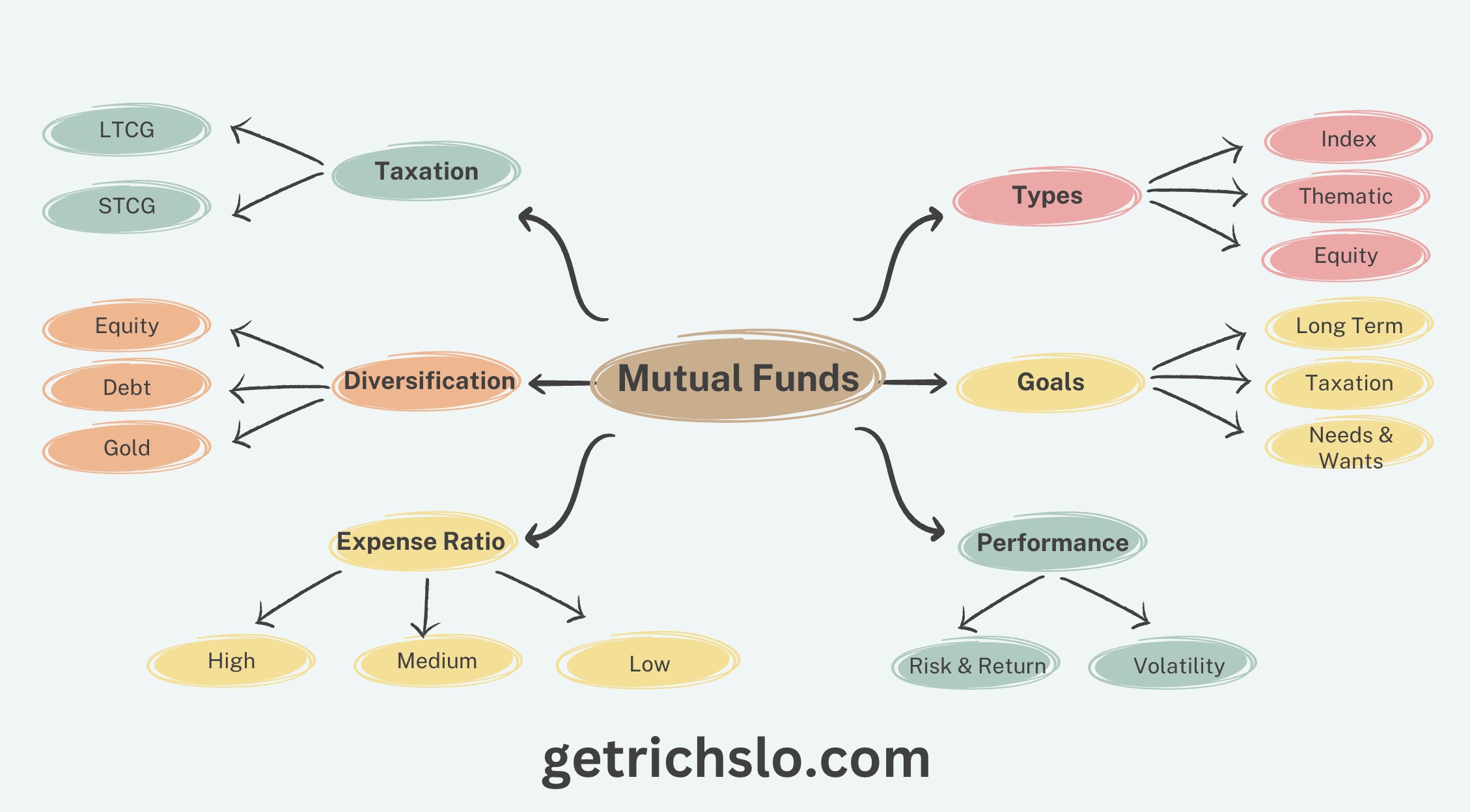

Mutual funds are investment vehicles that pool money from multiple investors and invest the money in a diversified portfolio of stocks, bonds, or other securities. In India, mutual funds are regulated by the Securities and Exchange Board of India (SEBI).

Choosing the right mutual fund is crucial for achieving financial goals, as the performance of the fund can have a significant impact on investment returns. In India, mutual funds have become increasingly popular in recent years due to their potential for higher returns and professional money management.

In India, there are over 40 mutual fund houses offering a wide range of mutual fund schemes. Choosing the right mutual fund is crucial for achieving financial goals and maximizing returns. Factors such as past performance, expense ratio, asset allocation, fund management team, and tax implications should be considered when selecting a mutual fund.

One of the biggest advantages of investing in mutual funds is that they offer diversification, which helps reduce risk. By investing in a diversified portfolio of securities, investors can minimize the impact of individual stock or bond fluctuations. Additionally, mutual funds are professionally managed, which can help investors achieve their financial goals by providing access to the expertise of experienced fund managers.

2. Assess Your Financial Goals

Assessing your financial goals is the first step in choosing the right mutual fund in India. Financial goals can include long-term goals such as retirement planning or short-term goals such as saving for a down payment on a home. The time horizon for achieving these goals is also an important factor to consider.

Identifying your financial goals and time horizon

To identify your financial goals, start by asking yourself what you want to achieve financially in the short-term and long-term. Some common financial goals include saving for a child’s education, buying a home, or building a retirement nest egg. Once you have identified your financial goals, determine the time horizon for achieving them. This will help you determine the appropriate investment strategy and the type of mutual fund that suits your goals.

Understanding your risk tolerance and investment preferences

Mutual funds offer different levels of risk and return, depending on the asset class and the investment strategy. Understanding your risk tolerance is important as it determines the type of mutual fund that you should invest in. For example, if you have a low risk tolerance, you may want to consider investing in debt funds, which invest primarily in fixed-income securities such as bonds. On the other hand, if you have a high risk tolerance, you may want to consider investing in equity funds, which invest primarily in stocks.

Investment preferences such as liquidity needs, investment horizon, and tax implications should also be considered. For example, if you have a short-term investment horizon and require liquidity, you may want to consider investing in liquid funds, which invest in short-term money market instruments.

3. Types of Mutual Funds

Mutual funds in India offer investors a variety of investment options that cater to different investment objectives, risk profiles, and investment horizons. Here are some of the most popular types of mutual funds in India:

Equity Funds

Equity funds are mutual funds that primarily invest in stocks of publicly traded companies. These funds offer the potential for higher returns but also carry higher risk due to the volatility of the stock market. Equity funds are suitable for investors with a higher risk tolerance and a longer investment horizon. In India, equity funds are further categorized into large-cap, mid-cap, and small-cap funds based on the market capitalization of the companies they invest in.

Debt Funds

Debt funds are mutual funds that primarily invest in fixed-income securities such as bonds, treasury bills, and commercial paper. These funds offer lower returns compared to equity funds but also carry lower risk. Debt funds are suitable for investors with a lower risk tolerance and a shorter investment horizon.

Index Funds

Index funds are mutual funds that replicate the performance of a specific market index such as the Nifty 50 or the BSE Sensex. These funds invest in the same stocks as the underlying index and offer returns that are similar to the benchmark index. Index funds are suitable for investors who want to invest in the stock market but do not have the expertise or time to analyze individual stocks.

Balanced Funds

Balanced funds are mutual funds that invest in a combination of equity and debt securities. These funds offer a balance between risk and return and are suitable for investors with a moderate risk tolerance. The allocation to equity and debt securities may vary depending on the investment objective of the fund.

Tax Saving Funds

Tax Saving Funds or Equity-Linked Saving Schemes (ELSS) are mutual funds that offer tax benefits under Section 80C of the Income Tax Act, 1961. These funds invest primarily in equities and offer a tax deduction of up to Rs. 1.5 lakh per year. ELSS funds have a lock-in period of 3 years, which makes them suitable for investors with a long-term investment horizon.

| Type of Mutual Fund | Risk Level | Investment Horizon | Return Potential |

|---|---|---|---|

| Equity Funds | High | Long-term | High |

| Debt Funds | Low | Short-term to Medium-term | Low to Moderate |

| Index Funds | Moderate to High | Long-term | Moderate to High |

| Balanced Funds | Moderate | Medium-term to Long-term | Moderate |

| Tax Saving Funds | High | Long-term | High |

Choosing the right type of mutual fund in India depends on the investor’s investment objective, risk tolerance, and investment horizon. Equity funds offer high returns but carry high risk, while debt funds offer lower returns but lower risk. Index funds and balanced funds offer a balance between risk and return. Tax-saving funds are suitable for investors who want to save tax while investing in equities. Investors should understand the risk and return associated with each type of mutual fund and choose the one that aligns with their investment objectives.

4. Performance Analysis

Performance analysis is a crucial step in the selection of mutual funds as it helps investors to understand how a fund has performed over time and whether it aligns with their financial goals and risk tolerance. Here are the key sub-topics to consider when analyzing mutual fund performance in the Indian context:

Evaluation of past performance

Past performance is often an indicator of future performance. Therefore, it is essential to evaluate the historical returns of the mutual fund you are considering investing in. Investors can look at the fund’s performance over different periods, such as one year, three years, five years, and ten years, to get a better understanding of the fund’s consistency and long-term potential.

Comparison with benchmark indices

Benchmark indices like Nifty 50, BSE Sensex, and Nifty Midcap 100 provide a standard for measuring a fund’s performance. Investors should compare the mutual fund’s returns with its benchmark index to determine how well it has performed relative to the market. For instance, if a mutual fund invests in large-cap stocks, it should be compared with Nifty 50, which represents the performance of large-cap companies in India.

Importance of long-term performance: It is essential to consider the long-term performance of a mutual fund rather than just short-term gains. Short-term performance can be influenced by various factors, such as market volatility and economic conditions. Long-term performance, on the other hand, reflects a fund’s ability to generate consistent returns over an extended period. Therefore, investors should analyze the fund’s performance over a more extended period to determine whether it aligns with their long-term financial goals.

5. Expense Ratio

Expense Ratio is the annual fee that is charged by mutual funds from investors to manage the fund. It is expressed as a percentage of the total assets under management (AUM) of the mutual fund. The expense ratio covers the fund’s operating expenses such as investment management fees, administrative costs, marketing expenses, and other miscellaneous expenses.

Impact on Investment Returns

Expense Ratio plays a crucial role in determining the returns earned by an investor. Since the expense ratio is charged as a percentage of AUM, a high expense ratio will reduce the net asset value (NAV) of the mutual fund, which will, in turn, reduce the returns earned by investors. As a result, choosing a low-cost mutual fund is essential for maximizing returns.

Comparison of Expense Ratios

Investors should compare the expense ratios of different mutual funds before making an investment decision. The Securities and Exchange Board of India (SEBI) has mandated mutual funds to disclose their expense ratios in the offer document and factsheets provided to investors. These documents can be found on the mutual fund company’s website or through the SEBI website.

Importance of Choosing a Low-Cost Mutual Fund

Choosing a low-cost mutual fund is important for several reasons. Firstly, a lower expense ratio means that more money is available for investment, which can increase returns in the long run. Secondly, a low-cost mutual fund will be less affected by market fluctuations, which can help investors to achieve their financial goals. Lastly, a low-cost mutual fund can help investors to save money in fees, which can compound over time and result in significant savings.

Here is a table showing the expense ratios of some popular mutual funds in India as of 31st December 2021:

| Fund Name | Expense Ratio |

|---|---|

| HDFC Top 100 | 1.85% |

| ICICI Prudential | 1.68% |

| Mirae Asset | 1.44% |

| Axis Bluechip | 1.85% |

| SBI Bluechip | 1.91% |

Note: Expense ratios are subject to change and may vary based on the plan and investment amount.

Choosing a low-cost mutual fund is essential for maximizing returns and achieving financial goals. Investors should compare the expense ratios of different mutual funds before making an investment decision and choose a fund that offers low expenses and consistent returns.

6. Asset Allocation

Asset allocation is the process of dividing investments among different asset classes such as equity, debt, gold, and real estate to achieve specific investment objectives. It is an important component of a well-diversified portfolio, and it helps in reducing the risk associated with investing in a single asset class.

Mutual funds offer investors a wide range of asset classes to choose from, making it easier to diversify their investments. Let’s take a look at the different asset classes and their performance in recent years:

Equity funds

Equity funds invest in stocks of companies listed on the stock exchange. These funds have the potential to generate high returns, but they also carry higher risk. Equity funds in India have generated an average return of 12-15% over the last decade. Debt funds: Debt funds invest in fixed income securities such as government bonds, corporate bonds, and money market instruments. These funds have lower risk than equity funds and provide stable returns. Debt funds in India have generated an average return of 6-8% over the last decade.

Gold funds

Gold funds invest in physical gold or gold-related securities. These funds act as a hedge against inflation and provide diversification to the portfolio. Gold funds in India have generated an average return of 10-12% over the last decade.

Real estate funds

Real estate funds invest in properties or real estate-related securities. These funds have the potential to generate high returns, but they are illiquid and carry higher risk. Real estate funds in India have generated an average return of 7-10% over the last decade. It is important to note that the performance of these asset classes can vary depending on market conditions and other factors. Therefore, it is important to maintain a diversified portfolio and periodically rebalance it to maintain the desired asset allocation.

Rebalancing involves selling or buying assets to bring the portfolio back to the desired asset allocation. For example, if the equity portion of the portfolio has increased significantly, an investor may need to sell some of the equity funds and invest in debt funds to maintain the desired asset allocation.

| Asset Class | Description | Recent Performance |

|---|---|---|

| Equity Funds | Invest in stocks of companies listed on the stock exchange. | 12-15% average return over the last decade |

| Debt Funds | Invest in fixed income securities such as government bonds, corporate bonds, and money market instruments. | 6-8% average return over the last decade |

| Gold Funds | Invest in physical gold or gold-related securities. | 10-12% average return over the last decade |

| Real Estate Funds | Invest in properties or real estate-related securities. | 7-10% average return over the last decade |

Diversification through asset allocation helps in reducing the risk associated with investing in a single asset class. Investors should choose an asset allocation that aligns with their risk appetite and investment objectives and periodically rebalance the portfolio to maintain the desired asset allocation.

7. Management Team and Fund House

Mutual funds are managed by a fund house, which is responsible for overseeing the investment process, managing the fund’s portfolio, and ensuring that the fund is in compliance with regulatory requirements. It is important for investors to evaluate the fund house and its management team before investing in a mutual fund, as the fund house’s performance and reputation can impact the performance of the mutual fund.

Evaluation of the fund management team and their experience

The management team of a mutual fund is responsible for making investment decisions on behalf of the investors. Investors should evaluate the experience and qualifications of the fund manager, as well as the size and turnover of the management team. A fund manager with a strong track record of success and experience managing similar types of funds is generally preferred.

Analysis of the reputation and track record of the fund house

Investors should also evaluate the reputation and track record of the fund house before investing in a mutual fund. The fund house’s reputation can impact the performance of the mutual fund, as well as the level of trust that investors have in the fund house. Investors can research the fund house’s history, its performance across different funds and market cycles, as well as its compliance and regulatory history.

Highlighting the importance of choosing a reputable fund house with a skilled management team

Choosing a reputable fund house with a skilled management team is important for investors who want to invest in mutual funds. A reputable fund house with a skilled management team can help ensure that the mutual fund is well-managed, with sound investment decisions and effective risk management. Such a fund house can also provide investors with better customer service and transparency in the investment process.

Table representing the importance of choosing a reputable fund house with a skilled management team:

| Factors | Importance |

|---|---|

| Fund manager’s experience and qualifications | High |

| Size and turnover of the management team | Medium |

| Fund house’s reputation | High |

| Fund house’s track record | High |

| Compliance and regulatory history | Medium |

| Transparency in the investment process | High |

| Customer service | High |

8. Tax Implications

Tax implications of mutual fund investment: Mutual fund investments in India are subject to various taxes, such as capital gains tax, dividend distribution tax (DDT), and securities transaction tax (STT). Let’s discuss each of these taxes in detail:

Capital Gains Tax

Capital gains tax is applicable on the profits earned from the sale of mutual fund units. The capital gains tax is of two types: short-term capital gains tax (STCG) and long-term capital gains tax (LTCG). STCG is applicable if mutual fund units are held for less than 12 months, and the tax rate is 15%. On the other hand, LTCG is applicable if mutual fund units are held for more than 12 months, and the tax rate is 10% on gains exceeding Rs. 1 lakh.

Dividend Distribution Tax (DDT)

DDT is a tax deducted at source by mutual fund houses on the dividends distributed to investors. The tax rate for equity mutual funds is 10%, including surcharge and cess, and for debt mutual funds, it is 25%, including surcharge and cess.

Securities Transaction Tax (STT)

STT is applicable on the purchase and sale of mutual fund units. The tax rate for equity-oriented mutual funds is 0.001% on the total purchase or sale value, and for non-equity-oriented mutual funds, it is 0.001% on the redemption value. Tax benefits offered by specific types of mutual funds:

Equity-Linked Saving Scheme (ELSS)

ELSS is a type of equity mutual fund that offers a tax benefit under Section 80C of the Income Tax Act. Investors can claim a deduction of up to Rs. 1.5 lakh on their taxable income by investing in ELSS funds. Moreover, ELSS funds have a lock-in period of three years, which means investors cannot redeem their investments before three years. The capital gains from ELSS funds are taxed at 10% on gains exceeding Rs. 1 lakh.

Debt Mutual Funds

Debt mutual funds are an ideal investment option for investors seeking regular income and capital preservation. The capital gains from debt mutual funds are subject to STCG and LTCG taxes, as discussed earlier. However, if investors hold debt mutual fund units for more than three years, the gains are taxed at the rate of 20% with the benefit of indexation.

Here is a summary :

| Tax Type | Applicable On | Tax Rate |

|---|---|---|

| Capital Gains Tax | Profits earned from sale of mutual fund units | STCG - 15% if held for less than 12 months. LTCG - 10% on gains exceeding Rs. 1 lakh if held for more than 12 months |

| Dividend Distribution Tax (DDT) | Dividends distributed to investors | Equity mutual funds - 10%, including surcharge and cess. Debt mutual funds - 25%, including surcharge and cess |

| Securities Transaction Tax (STT) | Purchase and sale of mutual fund units | Equity-oriented mutual funds - 0.001% on total purchase or sale value. Non-equity-oriented mutual funds - 0.001% on redemption value |

| Equity-Linked Saving Scheme (ELSS) | Investment under Section 80C of the Income Tax Act | Capital gains taxed at 10% on gains exceeding Rs. 1 lakh; deduction of up to Rs. 1.5 lakh on taxable income |

| Debt Mutual Funds | Capital gains from debt mutual funds | STCG and LTCG taxes as applicable; 20% with indexation benefit if held for more than three years |

Note : The percentage may vary, but this provides a structure.

Investors must consider the tax implications of mutual fund investments before investing. While mutual funds provide an opportunity to generate wealth, it is equally important to understand the tax implications to maximize returns. Additionally, investors can choose mutual funds that offer tax benefits, such as ELSS funds, to optimize their tax liability.

9. Conclusion

In conclusion, choosing the right mutual fund requires careful consideration of several factors. One must assess their financial goals, risk tolerance, and investment preferences to determine the most suitable mutual fund type. Evaluating the past performance of the fund, comparing its returns with benchmark indices, and analyzing its expense ratio are important aspects to consider. Asset allocation and diversification play a crucial role in mitigating risk and maximizing returns. The reputation and experience of the fund management team and the fund house are also essential factors to evaluate. Lastly, understanding the tax implications and benefits of investing in mutual funds is important. By considering all these factors, investors can make informed decisions and achieve their long-term financial goals. It is also important to seek professional guidance, if needed, to ensure a well-informed investment strategy.