1. Introduction

In India, mutual funds have emerged as one of the most popular investment options for individuals looking to grow their wealth. Mutual funds provide an opportunity to invest in a diversified portfolio of securities managed by professionals, offering the potential for higher returns than traditional savings options.

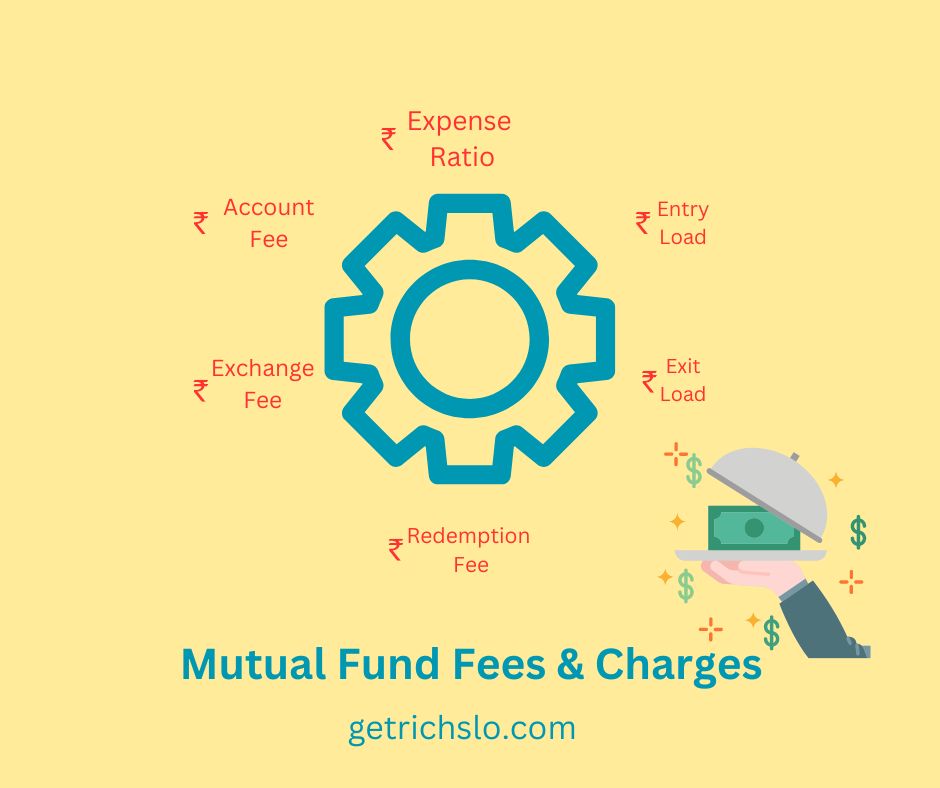

However, investors need to know the fees associated with mutual funds. These fees can significantly impact the returns investors earn over the long term, so understanding them is crucial before making investment decisions.

2. Types of Mutual Fund Fees and Charges

2.1 Expense Ratio

The expense ratio is the fee mutual fund companies charge for managing funds. It is calculated as a percentage of the assets under management. For example, if a mutual fund has an expense ratio of 1%, investors will pay Rs. 1 for every Rs. 100 invested in the fund.

The impact of the expense ratio on returns can be significant over the long term. For example, a mutual fund with an expense ratio of 2% can reduce the returns earned by an investor by up to 20% over ten years.

Factors that affect the expense ratio include the type of mutual fund, the size of the fund, and the investment strategy employed by the fund manager.

2.2 Entry Load

Entry load is a fee mutual funds charge at the time of investment. It is calculated as a percentage of the investment amount and deducted from it. For example, if a mutual fund has an entry load of 1%, an investor who invests Rs. 10,000 will pay Rs. 100 as an entry load.

The pros of investing in funds with front-end loads are that they help cover the cost of sales and marketing efforts, and they can incentivize the distributor to provide better service. The cons are that they reduce the amount of money invested in the fund, and they can discourage investors from investing.

2.3 Exit Load

Exit load is a fee mutual funds charge at the time of redemption. It is calculated as a percentage of the redemption amount and deducted from it. For example, if a mutual fund has an exit load of 1%, an investor who redeems Rs. 10,000 will pay Rs. 100 as an exit load.

The pros of investing in funds with back-end loads are that they incentivize investors to stay invested for a more extended period and help cover the cost of early redemption. The cons are that they reduce the amount of money redeemed by the investor, and they can discourage investors from saving.

2.4 Redemption Fees

Mutual fund companies charge redemption fees to discourage investors from redeeming their investments too soon. It is calculated as a percentage of the redemption amount and can vary depending on the mutual fund and the period specified.

Redemption fees are charged to discourage short-term trading, cover the cost of transaction fees associated with redemption, and protect long-term investors.

2.5 Exchange Fees

Exchange fees are charged by mutual fund companies when an investor switches from one mutual fund scheme to another. It is calculated as a percentage of the investment amount and is charged to cover administrative costs associated with the switch.

Exchange fees are charged to cover the cost of administrative expenses associated with the switch and discourage frequent switching.

2.6 Account Fees

Mutual fund companies charge account fees for maintaining an investor’s account. These fees can include charges for account maintenance, account statements, and other administrative expenses. The calculation of account fees can vary depending on the mutual fund company.

Types of account fees charged by mutual fund companies include annual maintenance, transaction, and account statement fees.

Overall, investors should know the various charges associated with mutual funds before making investment decisions. By understanding the impact of fees on returns and evaluating different mutual funds based on their fee structures, investors can make informed investment decisions that maximize returns and minimize costs.

3. Understanding the Impact of Mutual Fund Fees and Charges

Mutual fund fees are crucial in determining the returns on your investments. A higher price can significantly reduce your returns over the long term, while a lower cost can improve your returns. As per the data provided by the Association of Mutual Funds in India (AMFI), the average expense ratio for equity mutual funds in India is around 1.64%, while for debt funds, it is approximately 0.72%.

Comparing charges across mutual funds is essential to make an informed investment decision. For instance, let’s consider two mutual funds with similar investment objectives and returns but different expense ratios. Fund A has an expense ratio of 1%, while Fund B has an expense ratio of 2%. If you invest Rs. 1 lakh in each of these funds, and both funds generate an average annual return of 10% over the next ten years, the total returns for Fund A would be around Rs. 2.60 lakhs, while for Fund B, it would be around Rs. 2.35 lakh. This shows how a higher expense ratio can significantly impact your long-term returns.

Apart from the expense ratio, other charges such as entry loads, exit loads, redemption fees, exchange fees, and account fees also affect your returns. Therefore, it is essential to understand these charges and factor them into your investment decision.

Understanding the impact of mutual fund fees is critical for maximizing your investment returns. It is recommended to compare costs and charges across different mutual funds and evaluate their impact on your returns before making an investment decision.

4. How to Minimize Mutual Fund Fees and Charges

Minimizing mutual fund charges is essential for maximizing your investment returns in India. Here are some strategies to consider:

4.1 Choose the right share class

Mutual funds offer different share classes with varying fees and expenses. For instance, direct plans have a lower expense ratio than regular plans. Choosing the right share class can help you save significantly on fees over the long term.

4.2 Invest in no-load funds

No-load mutual funds do not charge any entry or exit load fees. This means you can buy or sell your investments without incurring any charges. Therefore, investing in no-load funds can help you save on transaction costs.

4.3 Consider exchange-traded funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. ETFs generally have lower expense ratios than mutual funds, making them a cost-effective option for investors.

4.4 Evaluate the impact of fees on returns before making investment decisions

Before investing in mutual funds, evaluating the impact of fees and expenses on your returns is crucial. You can use online calculators to estimate the potential impact of fees on your investments.

Minimizing mutual fund charges is crucial for maximizing your returns on investments. By choosing the suitable share class, investing in no-load funds, considering ETFs, and evaluating the impact of fees on returns, you can reduce your expenses and improve your investment performance in India.

5. Conclusion

In conclusion, understanding mutual fund charges are crucial for making informed investment decisions and maximizing your returns in India. Mutual fund charges include expense ratio, entry load, exit load, redemption, exchange, and account fees. These fees can significantly impact your investment returns over the long term.

Therefore, comparing fees across mutual funds, evaluating their impact on returns, and choosing suitable investment options that minimize expenses are essential. By selecting the appropriate share class, investing in no-load funds or ETFs, and evaluating the impact of fees on returns, investors can save on costs and achieve better investment performance.

It is worth noting that mutual fund regulations in India are continuously evolving, and investors must stay updated on any changes in charges. Additionally, investors must conduct thorough research and seek professional advice before making investment decisions.

Investors must educate themselves on mutual fund fees to make informed investment decisions, minimize expenses, and maximize returns. By adopting the above-mentioned strategies and staying up-to-date with regulatory changes, investors can achieve their investment goals in India.

6. FAQs on Mutual Fund Fees and Charges

The expense ratio is the annual fee mutual fund companies charge to cover operating expenses. This fee is deducted from your investment, and the remaining amount is used to buy mutual fund units. The higher the expense ratio, the lower your returns will be. For example, if you invest in a mutual fund with a 2% expense ratio that generates a 10% return, your actual return will be 8%.

Entry and exit loads are fees charged by mutual fund companies when you buy or sell their funds. Entry loads are set when you purchase mutual fund units, while exit loads are charged when you sell them. While these fees can reduce your returns, some funds may offer attractive returns despite the load charges. So, it is essential to evaluate the fund's performance before investing.

Redemption fees are charged by some mutual fund companies when you sell your mutual fund units within a certain period after buying them. The purpose of redemption fees is to discourage investors from making frequent trades and to help the fund manager to manage the fund's portfolio effectively. Redemption fees can vary depending on the mutual fund company and the duration you hold the units.

Several ways to minimize mutual fund fees include investing in no-load funds, choosing the suitable share class, and considering exchange-traded funds (ETFs). No-load funds do not charge sales commissions, so all your money is invested in the mutual fund. Choosing a suitable share class can also help you avoid unnecessary fees. ETFs can be a good option for investors looking to minimize expenses and enjoy the benefits of diversification.

Mutual fund charges can significantly impact your investment returns over the long term. Therefore, comparing the fees of different mutual funds before investing is essential. This will help you choose the fund that offers the best returns while minimizing expenses. Comparing prices can also help you avoid investing in funds with excessive fees or hidden costs.