1. Introduction

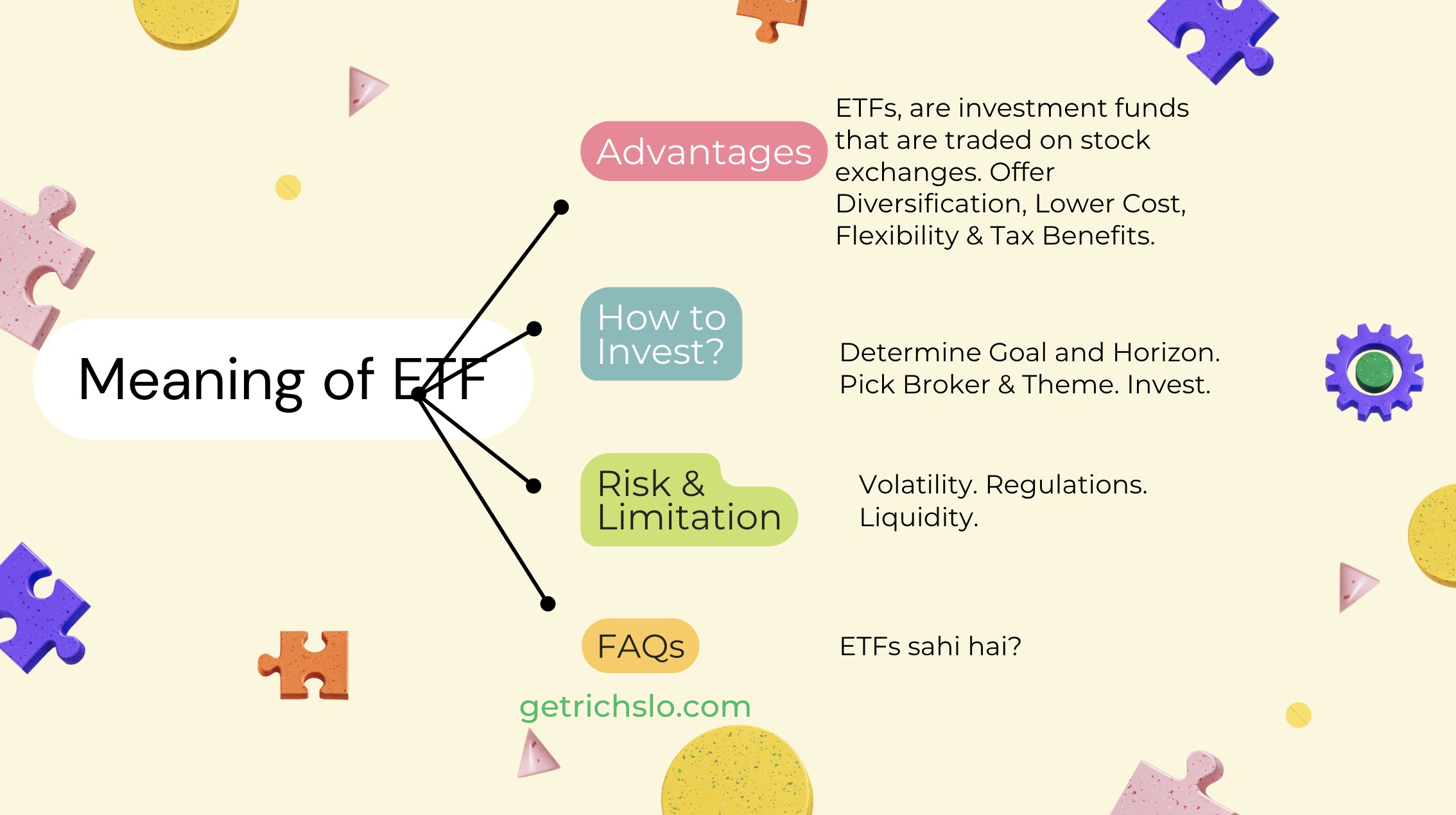

Exchange Traded Funds, or ETFs, are investment funds traded on stock exchanges, much like individual stocks. They are designed to track the performance of a particular market index, such as the NIFTY 50 or Bank Nifty, or a specific sector, such as technology or healthcare.

2. Understanding ETFs

2.1 Definition and Structure of ETFs

ETFs are designed to track the performance of a particular index or sector, such as the NIFTY 50 or the BANK NIFTY. ETFs are structured as open-end investment companies, issuing and redeeming shares based on investor demand.

2.2 Types of ETFs Available in the Market

Several types of ETFs are available in the market, including index ETFs, bond ETFs, sector ETFs, and international ETFs. Index ETFs track the performance of a particular index, while bond ETFs invest in bonds and other fixed-income securities. Sector ETFs invest in a specific market sector, such as technology or healthcare, while international ETFs provide exposure to foreign markets.

2.3 Trading of ETFs on Stock Exchanges

ETFs are traded on stock exchanges, which means they can be bought and sold like individual stocks. ETFs trade throughout the day, and their price fluctuates based on supply and demand. This allows investors to buy and sell ETFs anytime during trading, providing greater flexibility and control over their investments.

Understanding the basics of ETFs, including their definition, structure, types, and trading on stock exchanges can help investors make informed decisions when considering ETFs as a potential investment option.

2.4 Popularity and Benefits of Investing in ETFs

ETFs have become increasingly popular among investors due to their numerous benefits. ETFs provide investors a cost-effective and convenient way to diversify their portfolios and gain exposure to a broad range of assets. They also offer greater flexibility in trading and lower management fees compared to traditional mutual funds. Additionally, ETFs are highly liquid, providing investors with easy access to their investments and offering tax advantages.

2. Advantages of investing in ETFs

2.1 Diversification and Risk Reduction

One of the primary advantages of investing in ETFs is the ability to diversify your portfolio across a wide range of assets, which helps reduce risk. ETFs are designed to track the performance of a particular index or sector, and by investing in an ETF, you gain exposure to a broad range of stocks or other assets within that index or sector. This can spread your risk and reduce the impact of any individual asset’s performance on your overall portfolio.

2.2 Lower Costs Compared to Actively Managed Funds

ETFs typically have lower management fees than actively managed funds, making them a more cost-effective investment option. This is because ETFs are passively managed and designed to track the performance of a particular index or sector, which requires less active management and research by fund managers.

2.3 Flexibility in Trading and Holding ETFs

ETFs offer greater flexibility in trading and holding than traditional mutual funds. ETFs are traded on stock exchanges so you can buy and sell them during trading hours, just like individual stocks. This gives investors greater control over their investments and allows them to react quickly to market movements.

2.4 Tax Benefits of Investing in ETFs

ETFs can offer tax advantages for investors, particularly in terms of capital gains taxes. Because ETFs are passively managed, they typically have a lower turnover of assets compared to actively managed funds. This can result in lower capital gains taxes for investors, as gains are realized less frequently.

Overall, ETFs provide investors with various advantages, including diversification, lower costs, greater flexibility, and potential tax benefits. These benefits make ETFs an attractive investment option for those seeking financial goals.

4. How to invest in ETFs

4.1 Setting Investment Goals and Identifying Suitable ETFs

Before investing in ETFs, it is essential to set investment goals and identify suitable ETFs that align with those goals. This involves understanding your risk tolerance, investment time horizon, and financial objectives. Once you clearly understand your investment goals, you can research and identify ETFs that align with your investment strategy.

4.2 Choosing Between Physical and Synthetic ETFs

When investing in ETFs, you can choose between physical and synthetic ETFs. Physical ETFs hold the underlying securities they track, while synthetic ETFs use derivatives to replicate the performance of the underlying index. It is essential to understand the differences between physical and synthetic ETFs and choose the one best suited to your investment goals.

4.3 Selecting the Right ETF Brokerage Account and Opening an Account

To invest in ETFs, you must select the proper ETF brokerage account and open an account. This involves researching and comparing different ETF brokers and selecting the best suits your investment goals and preferences. Once you have chosen an ETF brokerage account, you can open an account and fund it with the necessary capital to start investing.

4.4 Placing Orders and Monitoring the ETF Investments

Once you have selected suitable ETFs and opened an ETF brokerage account, you can start investing in ETFs. This involves placing orders to buy and sell ETFs through your brokerage account. It is essential to monitor your ETF investments regularly and make adjustments as necessary to ensure that they align with your investment goals and objectives.

Investing in ETFs can be a simple and cost-effective way to gain exposure to a broad range of assets and achieve your investment goals. By understanding how to invest in ETFs and following best practices for investing, you can make informed decisions and achieve financial success.

5. Risks and limitations of ETFs

While ETFs offer several advantages, risks, and limitations are associated with investing in them. Understanding these risks can help you make informed investment decisions and manage your portfolio effectively.

5.1 Concentration Risk and the Impact of Underlying Asset Performance

ETFs are typically designed to track the performance of a specific market or index. As a result, they are exposed to the performance of the underlying assets in that index or market. If a few of the underlying investments perform poorly, it can significantly impact the ETF’s overall performance, leading to concentration risk.

5.2 Liquidity Risk and Trading Volumes

ETFs are traded on stock exchanges like individual stocks, which means they are subject to liquidity risk. This is the risk that you may not be able to buy or sell shares of the ETF when you want to due to low trading volumes. This can result in wider bid-ask spreads and potentially lead to investor losses.

5.3 Tracking Error and the Impact of Market Volatility

ETFs are designed to track the performance of a specific market or index, but they may only partially replicate the performance due to tracking errors. Tracking error occurs due to differences in the weighting of the assets in the ETF compared to the index it tracks. During periods of market volatility, tracking errors can be more pronounced, leading to higher risk levels for investors.

5.4 Regulatory Risks and Changes in ETF Regulations

ETFs are subject to regulatory risks, including changes to the regulatory environment that could impact their operations or performance. For example, changes in tax laws or securities regulations could affect the tax treatment of ETFs or their ability to hold particular securities.

Investing in ETFs is essential to be aware of these risks and limitations. By understanding the potential risks and taking steps to manage them, you can make informed investment decisions and achieve your financial goals.

6. Conclusion

ETFs can be a great investment option for investors looking for diversification, lower costs, flexibility, and tax benefits. However, they also come with risks and limitations that investors should know.

This article covered the advantages and risks of investing in ETFs, including diversification, lower costs, flexibility in trading and holding, and tax benefits. We also discussed risks like concentration, liquidity, tracking error, and regulatory risks.

It is important to remember that ETFs are designed to track the performance of a specific market or index, so it is crucial to understand the underlying assets of the ETFs you are investing in. Seeking professional advice from a financial advisor or broker can also help you make informed investment decisions and manage your portfolio effectively.

In conclusion, ETFs can be a valuable investment tool, but weighing the advantages and risks before making any investment decisions is crucial. By understanding the risks and taking steps to manage them, you can make informed decisions and achieve your financial goals.

7. FAQs on ETFs

Yes, ETFs can be a good investment option for Indian investors. They offer advantages like diversification, lower costs, flexibility, and tax benefits.

To choose the right ETF for your investment goals in India, consider factors like the underlying assets, expense ratio, liquidity, and tracking error. You should also align your investment goals with the investment objective of the ETF.

Yes, Indian investors can invest in international ETFs. However, some specific regulations and restrictions need to be followed. Investors can invest in international ETFs through Indian brokers who offer access to global markets.

The minimum investment required to invest in ETFs in India can vary depending on the ETF and the brokerage firm. Generally, the minimum investment can range from Rs. 500 to Rs. 10,000.

Various types of ETFs are available in India, including equity ETFs, debt ETFs, gold ETFs, sectoral ETFs, and international ETFs. Equity ETFs are the most popular in India and track various market indices, while debt ETFs invest in fixed-income securities. Gold ETFs follow the price of gold, and sectoral ETFs invest in a specific sector or industry.