1. Introduction to Asset Allocation

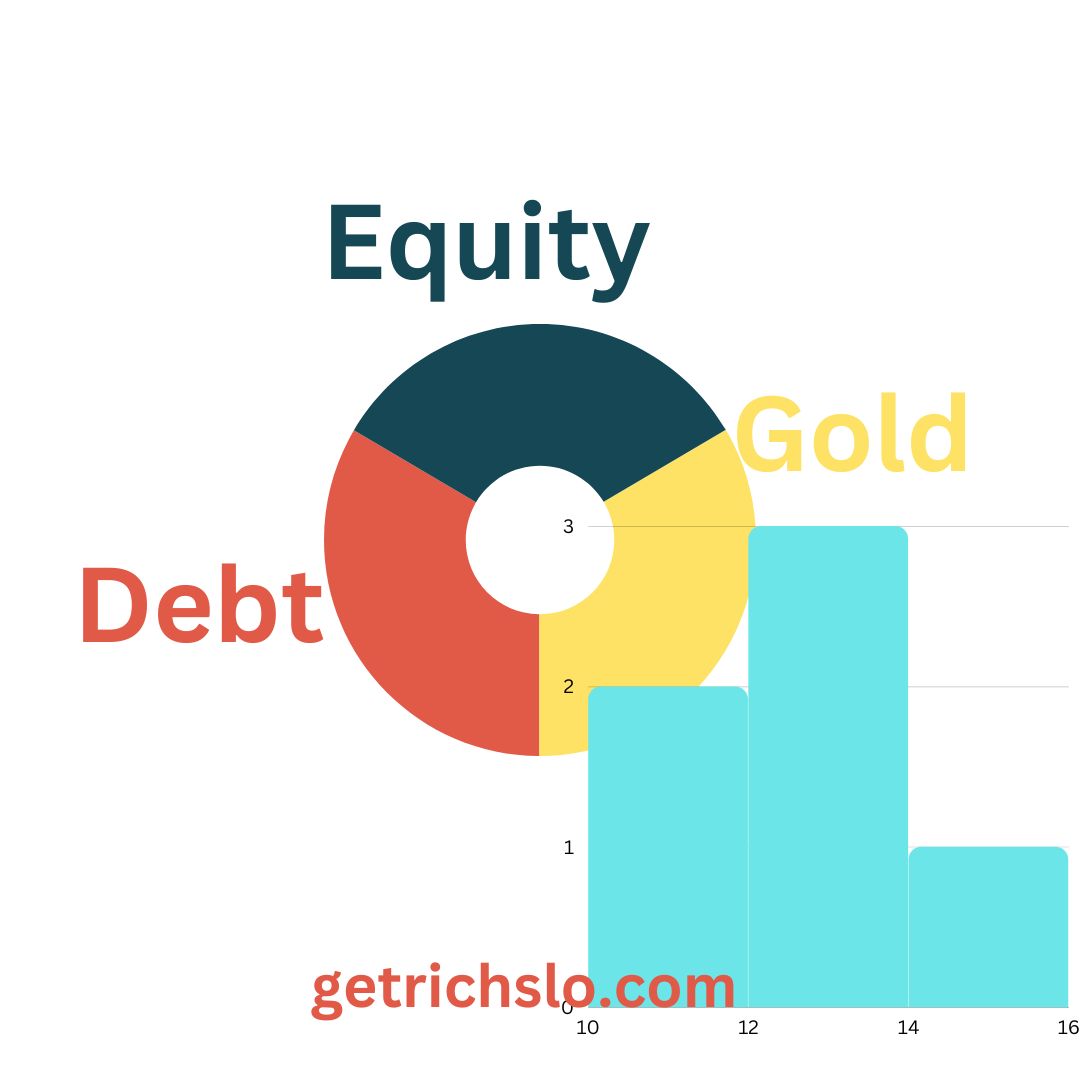

Asset allocation is a crucial process in investment management, where an individual divides their investment portfolio among different asset classes, such as equities, debt, and cash. It is the process of deciding how to distribute your investment portfolio across various asset classes to achieve optimal returns for a given level of risk.

Asset allocation has become increasingly popular as people seek to diversify their portfolios and minimize risk. According to a survey conducted by ICICI Securities, 73% of Indian investors prefer mutual funds as an investment option due to their potential for higher returns and diversification benefits.

Asset allocation balances risk and reward, considering an individual’s investment goals, risk tolerance, and time horizon. For example, someone with a high-risk tolerance and a long-term investment horizon might invest more in equities. In contrast, someone with a lower risk tolerance and a shorter investment horizon might choose to invest more in debt securities.

Factors influencing asset allocation include an individual’s investment goals, financial situation, risk tolerance, and time horizon. It is crucial to consider these factors before making any investment decisions.

2. Types of Mutual Funds

Mutual funds have become an increasingly popular investment option in India, with over 4.3 crores (43 million) of mutual fund investor accounts as of January 2022. Mutual funds are professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of assets.

Equity mutual funds invest primarily in equity shares of companies, providing higher potential returns and carrying more elevated risk. As of January 2022, equity mutual funds had assets under management (AUM) of over Rs. 19 lakh crore (approx. USD 257 billion).

Debt mutual funds, on the other hand, invest primarily in fixed-income securities such as bonds, government securities, and money market instruments, providing lower potential returns but also carrying lower risk. As of January 2022, debt mutual funds had an AUM of over Rs. 14.5 lakh crore (approx. USD 196 billion).

Balanced mutual funds, or hybrid funds, invest in a mix of equity and debt instruments to balance risk and return. As of January 2022, balanced mutual funds had an AUM of over Rs. 2.5 lakh crore (approx. USD 34 billion).

The advantages of investing in mutual funds include diversification, professional management, liquidity, and convenience. Mutual funds provide access to a diversified portfolio of securities, which helps to reduce risk. Fund managers with the expertise professionally manage them to analyze markets and choose suitable investments.

Mutual funds also offer liquidity, as investors can redeem their units anytime. Finally, investing in mutual funds is convenient, as it does not require investors to manage their portfolios actively.

However, some disadvantages of mutual funds include fees and expenses, lack of control, and market risk. Mutual funds charge fees and costs, which can reduce returns. Investors also have limited control over the investments made by the fund managers, which can lead to investments in securities that do not align with their values or investment goals. Finally, mutual funds are subject to market risk, and their returns can fluctuate based on market conditions.

3. Systematic Investment Plan (SIP)

Systematic Investment Plan (SIP) is a popular investment option in India that enables investors to invest a fixed amount of money at regular intervals in mutual funds. SIP allows investors to benefit from the power of compounding and rupee cost averaging, which means investing at different market levels to reduce the impact of market volatility.

One of the main benefits of SIP is its flexibility. Investors can start with as little as Rs. 500 per month and gradually increase their investment amount over time. SIPs also offer the convenience of automatic investments, as the investment amount is automatically debited from the investor’s bank account at regular intervals.

SIPs have become increasingly popular in India, with over 4.4 crores (44 million) of SIP accounts as of January 2022, representing a 22% year-on-year growth in SIP accounts. The total AUM of SIPs in India was over Rs. 5.6 lakh crore (approx. USD 75 billion) as of January 2022.

SIPs work by investing a fixed amount of money at regular intervals in a mutual fund. The investment spreads over time, reducing market volatility’s impact on the overall investment. The investment amount is automatically debited from the investor’s bank account at regular intervals, usually monthly.

One of the critical advantages of SIPs is the ability to benefit from rupee cost averaging. This means that investors buy more units when the market is down and fewer units when the market is up. Over time, this can result in a lower average cost per unit and higher overall returns.

When compared to lump sum investments, SIPs can offer several advantages. Lump sum investments require investors to time the market, which can be challenging even for experienced investors. SIPs, on the other hand, take the emotion out of investing and enable investors to benefit from the power of compounding over time.

4. Risk Management

Investing always involves some risk; understanding these risks is essential to successful investing. In the Indian context, several investment risks exist, including market, credit, inflation, interest rate, and liquidity.

Market risk is the risk of losses due to changes in market conditions, such as economic downturns, changes in interest rates, or global events that impact the stock markets. Credit risk is the risk of losses due to borrowers' defaults or the downgrading of credit ratings. Inflation risk is the risk of losses due to the impact of inflation on the value of investments. Interest rate risk is the risk of losses due to changes in interest rates. Liquidity risk is the risk of losses due to the inability to sell investments when needed.

Assessing and managing investment risks involves understanding the risks associated with each investment and developing a risk management strategy that aligns with an individual’s investment goals, risk tolerance, and time horizon. One of the key risk management strategies is diversification, which involves investing in a mix of asset classes, such as equities, debt, and cash, to spread the risk.

Diversification is an effective risk management strategy as it helps reduce the investment portfolio’s overall risk by spreading it across different asset classes. For instance, if an investor has invested all their money in equities, they could be exposed to a high level of market risk. However, by diversifying their portfolio with debt and cash investments, they can reduce the overall risk and increase the stability of their investment portfolio.

There have been several incidents where investors have suffered significant losses due to inadequate risk management strategies. For example, the global financial crisis of 2008 resulted in substantial losses for Indian investors who had invested heavily in the US stock markets. Similarly, the recent pandemic-led market volatility led to losses for investors who had invested heavily in high-risk assets.

5. Taxation of Mutual Funds

Taxation is an essential consideration for investors in India, and mutual fund investments are subject to specific taxation rules. The tax treatment of mutual funds varies depending on the type of mutual fund, the holding period, and the gains realized on the investment.

In India, mutual funds are subject to a capital gains tax levied on the gains realized from the sale of mutual fund units. The capital gains tax is calculated based on the holding period of the mutual fund units. If the mutual fund units are held for less than three years, they are considered short-term capital assets, and the gains are taxed as per the individual’s income tax slab rate. If the mutual fund units are held for more than three years, they are considered long-term capital assets, and the gains are taxed at a flat rate of 20% with the benefit of indexation.

Tax-saving mutual funds, or Equity-Linked Savings Schemes (ELSS), are a popular investment option for Indian investors as they provide tax benefits under Section 80C of the Income Tax Act. Investors can claim a tax deduction of up to Rs. 1.5 lakh per annum by investing in ELSS funds. ELSS funds have a lock-in period of three years, and the gains realized on these funds are also subject to capital gains tax rules.

Unlike other investment options such as fixed deposits, savings accounts, and real estate, mutual funds offer several tax advantages. For instance, mutual funds provide better tax efficiency than fixed deposits. The gains realized from mutual funds are subject to capital gains tax, generally lower than the income tax rates applicable to fixed deposits. Additionally, mutual funds offer greater flexibility in terms of investment amounts and horizons, making them an attractive investment option for many investors.

6. Portfolio Rebalancing

Portfolio rebalancing is an essential investment strategy that involves adjusting the allocation of assets in an investment portfolio to maintain a desired risk-return profile. Rebalancing helps investors to keep their investments aligned with their investment goals, risk tolerance, and time horizon.

Portfolio rebalancing involves selling overperforming assets and buying underperforming assets to return the portfolio to its original allocation. This can be done in several ways, such as selling a portion of the overperforming assets, adding more funds to the underperforming assets, or both. The frequency of portfolio rebalancing depends on the individual’s investment goals, risk tolerance, and market conditions.

In India, portfolio rebalancing is significant due to the stock market’s volatility. According to a report by CRISIL, the Indian stock market witnessed a substantial decline of 23% in March 2020 due to the COVID-19 pandemic. This highlights the importance of having a well-diversified investment portfolio and rebalancing it regularly to maintain the desired risk-return profile.

Investors should consider several factors while rebalancing their portfolio, such as changes in their investment goals, changes in market conditions, and changes in their risk tolerance. For instance, if an investor’s investment goal changes from long-term to short-term, they may want to rebalance their portfolio to reduce risk exposure. Similarly, if the market conditions change, investors may want to rebalance their portfolios to take advantage of new investment opportunities.

7. Alternative Investments

Alternative investments are non-traditional investment vehicles that differ from traditional investments, such as stocks, bonds, and mutual funds. Alternative investments include real estate, commodities, private equity, hedge funds, and venture capital.

In India, alternative investments have gained popularity in recent years due to their potential for higher returns than traditional investments. According to a report by Preqin, alternative assets under management (AUM) in India grew from $50 billion in 2013 to $83 billion in 2019, representing a CAGR of 7.2%.

Alternative investments offer several advantages, including the potential for higher returns, diversification benefits, and reduced correlation with traditional assets. However, they also have disadvantages, such as higher fees, illiquidity, and risk.

Investors can include alternative investments in their portfolio by allocating a portion of their assets to alternative investments that align with their investment goals, risk tolerance, and time horizon. For instance, investors looking for stable long-term returns may consider investing in real estate or private equity funds. In contrast, investors looking for high-risk, high-return opportunities may consider investing in hedge or venture capital funds.

It is essential to conduct thorough research and due diligence before investing in alternative investments. They can be more complex and require more expertise than traditional investments. Investors should also consider the fees associated with alternative investments, as they can be significantly higher than conventional investments.

8. Retirement Planning

Retirement planning is crucial to ensure a comfortable and financially secure retirement. In India, retirement planning is becoming increasingly important due to the rising life expectancy and healthcare costs; according to a report by the World Economic Forum, India’s retirement savings gap is estimated to be $85 trillion, highlighting the need for individuals to plan for their retirement.

There are several retirement planning options available in India, including the Employee Provident Fund (EPF), National Pension System (NPS), and Public Provident Fund (PPF). The EPF is a government-backed savings scheme that is mandatory for employees earning a monthly salary of up to Rs. 15,000. The NPS is a voluntary contribution-based retirement savings scheme that is open to all citizens of India. The PPF is a long-term savings scheme backed by the government.

Asset allocation plays a vital role in retirement planning. It helps individuals achieve their retirement goals by investing in assets that align with their investment goals, risk tolerance, and time horizon. By allocating a portion of their assets to equities, debt, and cash, individuals can manage their risk and ensure that their investments are diversified.

One of the critical factors to consider while planning for retirement is the time horizon, as individuals have a longer investment horizon during their working years, enabling them to invest in higher-risk assets such as equities. As individuals approach retirement, they need to shift their focus toward lower-risk investments, such as debt and cash, to ensure that their investments are protected against market fluctuations.

9. Conclusion

In conclusion, asset allocation is a crucial aspect of investment planning that helps individuals to achieve their investment goals while managing risk. Asset allocation involves dividing an investment portfolio among asset classes, such as equities, debt, and cash, based on an individual’s investment goals, risk tolerance, and time horizon. It is an effective strategy to reduce investment risk and achieve portfolio diversification.

In India, investing in mutual funds is gaining popularity among retail investors, as it provides an easy and affordable way to invest in a diversified portfolio of assets. The growth of the mutual fund industry in India is evident from the fact that the assets under management (AUM) reached a record high of Rs. 38.25 lakh crore in January 2022, an increase of 40% from the previous year.

Other important aspects of investment planning that individuals need to consider include risk management, taxation of investments, retirement planning, and portfolio rebalancing. These factors are essential to achieve long-term financial goals and building wealth over time.

A well-planned asset allocation strategy, along with regular review and monitoring, can help individuals to achieve their investment goals and manage investment risk. By seeking professional advice and investing in a diversified portfolio of assets, individuals can build wealth and secure their financial future.

10. FAQs on Asset Allocation

The perfect asset allocation for an Indian investor depends on investment goals, risk tolerance, and time horizon. Generally, a balanced asset allocation that includes equities, debt, and cash may work for most Indian investors. However, investors should consult a financial advisor and review their investment strategy periodically.

Investors can determine their risk tolerance by considering their age, financial goals, income, and investment experience. Investors with a higher risk tolerance may opt for a higher allocation to equities, while those with a lower risk tolerance may prefer a higher budget to debt instruments.

Asset allocation can help in tax planning by investing in tax-efficient instruments such as tax-saving mutual funds, ELSS, and NPS. Investors can also consider investing in debt funds that offer indexation benefits to reduce the tax liability on capital gains.

The frequency of portfolio rebalancing depends on investment goals, risk tolerance, and market conditions. As a general rule of thumb, investors should review their portfolio periodically, typically once a year, and rebalance it if the actual allocation deviates significantly from the target allocation.

Investors can diversify their investment holdings by offering alternative investments such as real estate, gold, and commodities. However, alternative investments carry a higher risk than traditional investments and require a thorough understanding of the instrument. Investors should seek professional advice before investing in alternative investments.